Global Finance | Balance of Payments I

EC 380 - International Economic Issues

2025

Recap

Previously

- With globalization comes greater economic interdependence and larger risk of contagion effects once crises crop up

Today

Explore the system used to track country’s international transactions

Establish relationship between domestic investment, domestic savings, and international flow of goods, services, and financial assets

Examine the consequences of international indebtedness

Layout

There are three separate accounts for the Balance of Payments:

- Current Account

- Capital Account

- Financial Account

Account Types

Current Account Basics

Definition: Records the transaction of goods, services, investment income, and unilateral transfers between residents of a country and the rest of the world

Exports & Imports

Income on Equities

Income on Debt-related Assests

Repatriated Income by Multinational Enterprise (MNE) firms

Current Account Inflows

Current Account Inflows are monetary inflows, exchanged for goods/services outflows

Country current account surplus implies CA Inflows are greater than CA Outflows

\(\Rightarrow\) Outflow of goods, services, investment income, etc. of country are greater than inflows

Capital & Financial Accounts

Capital Account:

Records transactions of highly specialized financial assets and liabilities and one-time capital transfers (transfers that do not occur frequently)

- Gifts of an embassy

- Acquisition of land for embassy use

Financial Account:

Tracks investment flows between economies, usually long-lasting items relative to goods or services

- Foreign Investment

- Purchase or sales of foreign stock & bonds

- International bank lending

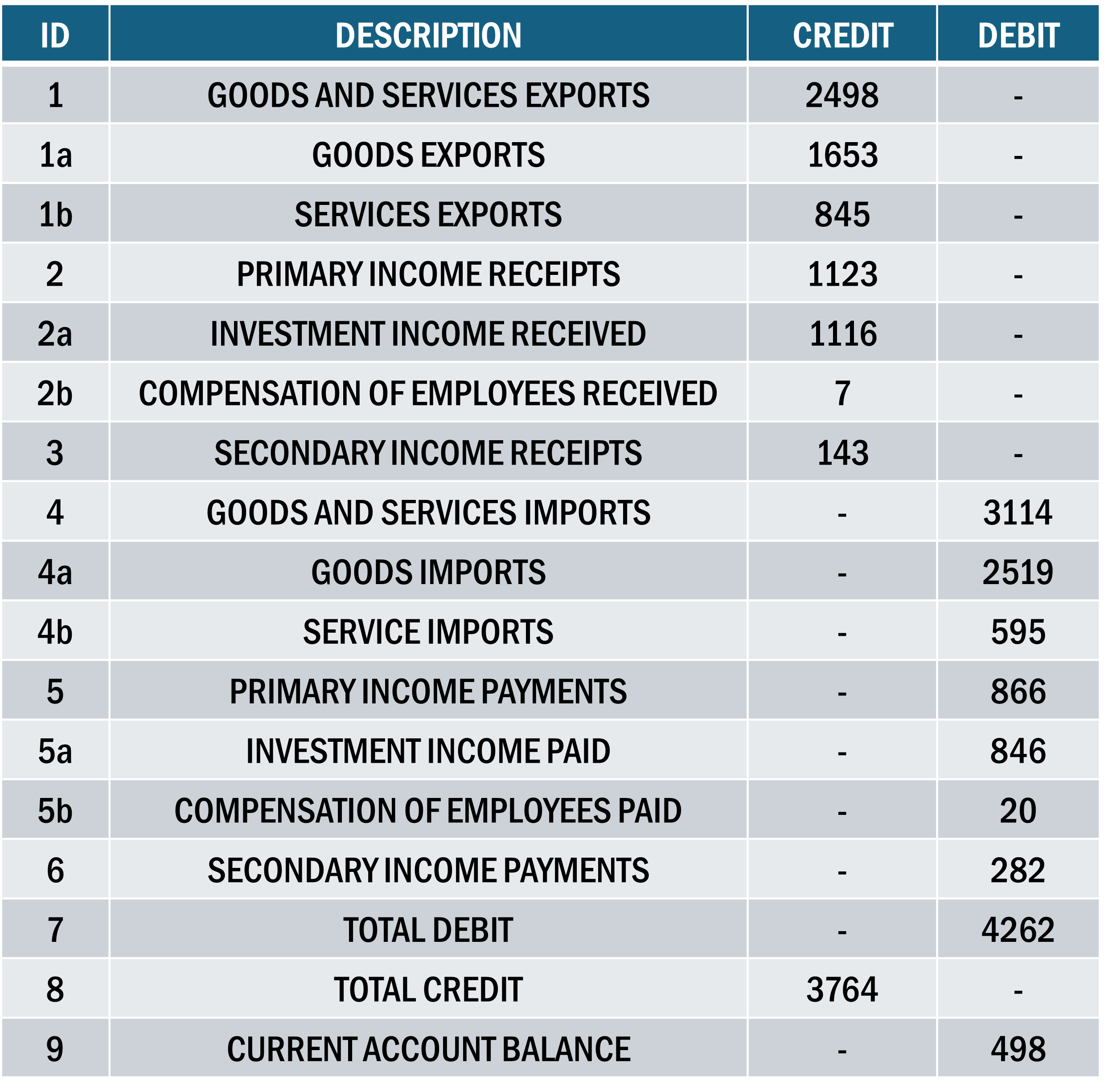

CA: Trade Balance

The trade balance is total exports minus total imports

- A trade balance deficit is a case in which total imports of goods and services outweighs total exports

- It is possible to maintain a deficit in goods and surplus in services, but normally the net amount of both is considered

For the US, the 2023 USD trade balance was $3,053.5 bn minus $3,826.9 bn, or -$773.4 bn.

Because the value is negative, the United States had a trade deficit

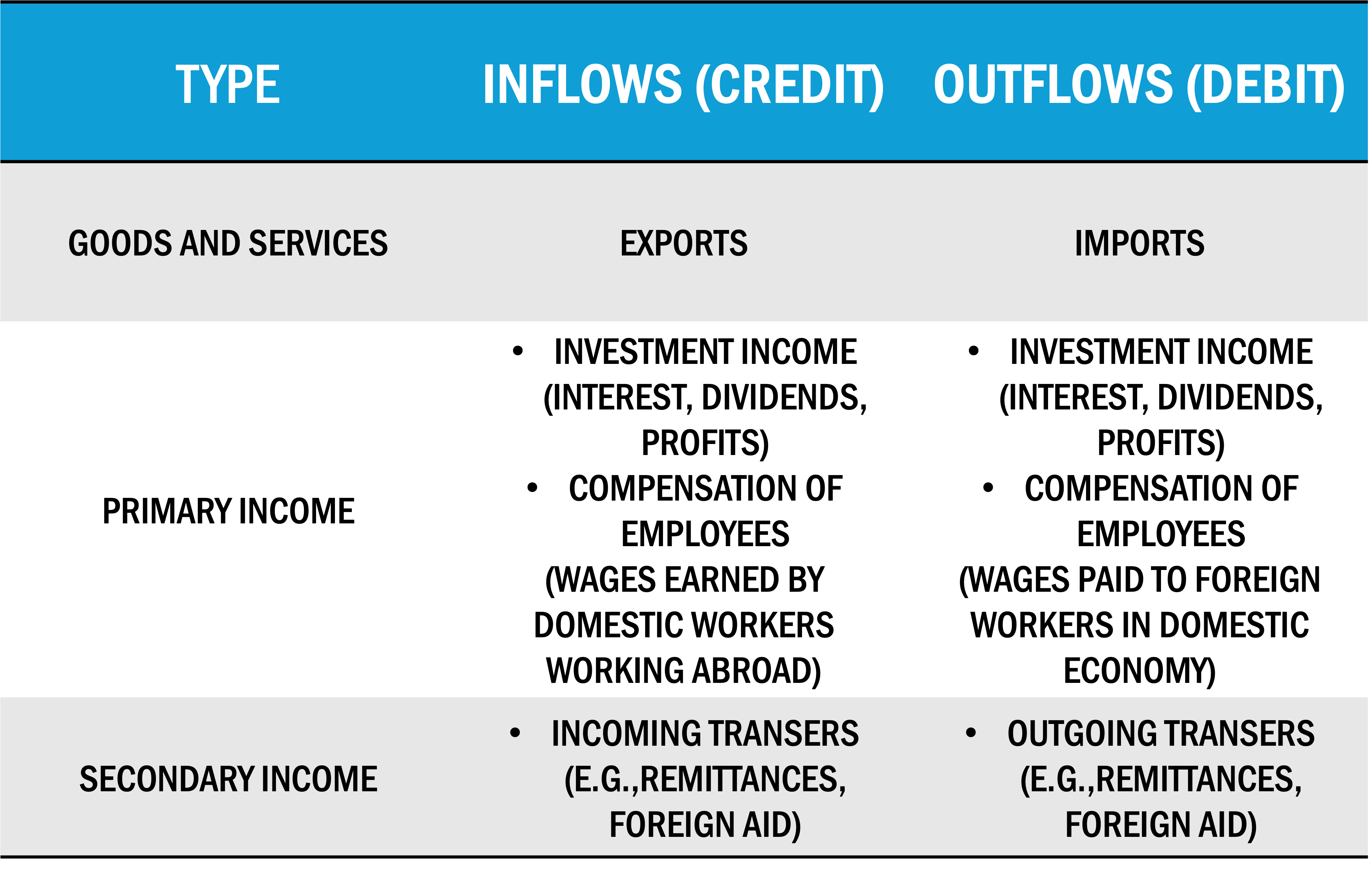

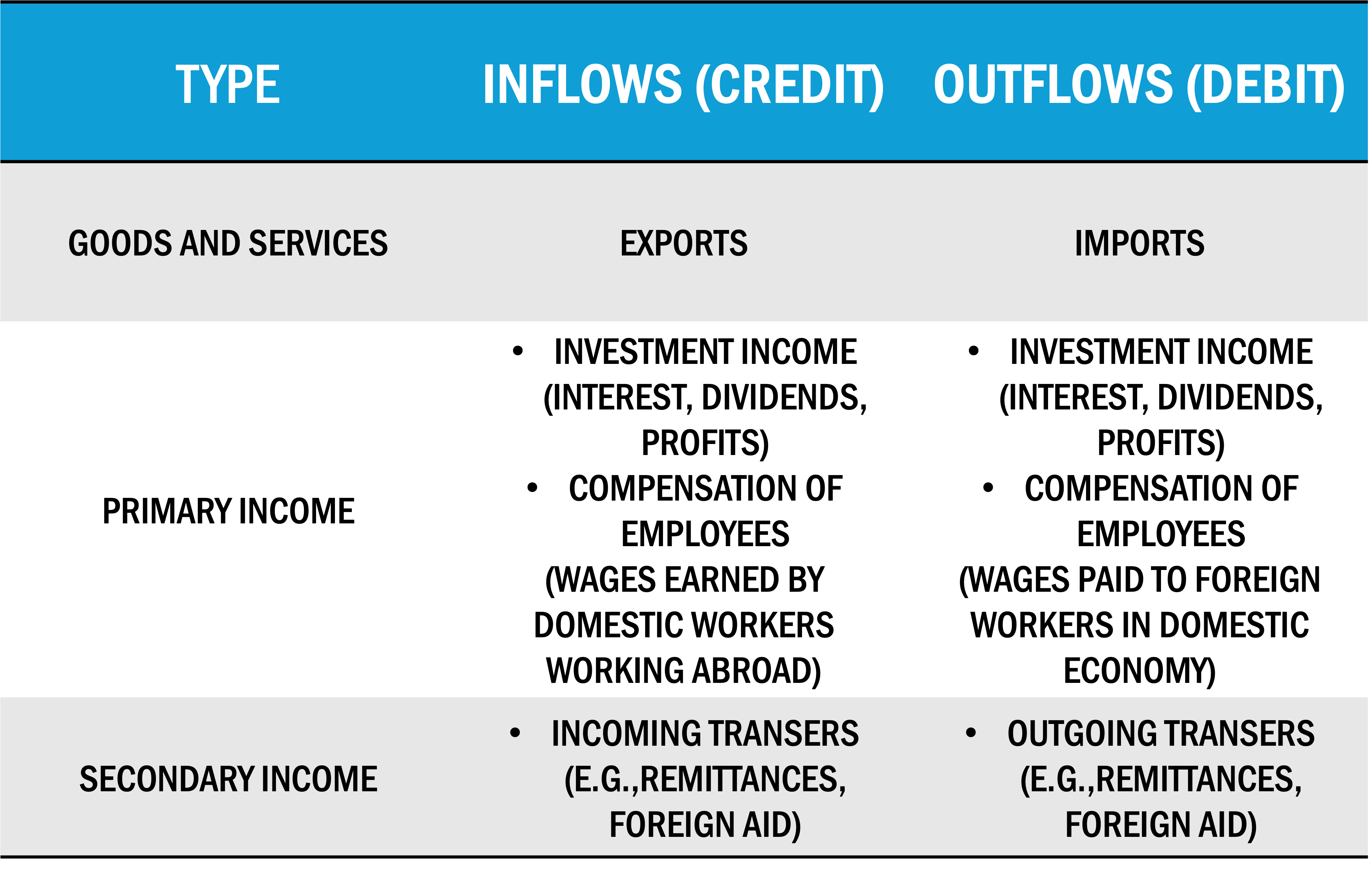

CA: Breakdown

Current Account measures all current, non-capital transactions between a nation and the rest of the world

Goods and Services trade (Trade Balance)

Earned income paid abroad and received from abroad (Primary Income)

International transfer payments (Secondary Income)

All three of these items have credit and debit components in BoP and in the construction of CA balance

CA: Breakdown

CA: Breakdown

Investment income items not to be confused with the flow of investment capital used to buy a business or company shares

Investment income is the income received or paid on the existing investments

CA: Primary Income

Useful to think of primary income as payments or receipts for use of financial capital

If a US company invests in Mexico’s stock market, the initial investment will not show up in the current account but will be included in the financial account.

Subsequent flow of dividends back to the US company will be counted in the United States as income received and in Mexico as income paid.

If US company operating in Mexico pays wages from its home in the US, the wages are included in the primary income category of the current account and are recorded as a receipt by Mexico and payment by the US.

CA: Secondary Income

Secondary Income includes payments made that are not in exchange for a good or service

- Foreign aid, or the remittances (transfer of wages earned in one country to residents of another country) of immigrants temporarily residing in another country

In US, payments are small relative to the overall current account

Transfers are sometimes very important to developing countries receiving large volumes of either foreign aid or remittances from their citizens working abroad

CA: Calculate Balance

CA: US Case

The US current account deficit has been trending downwards for the past 50 years

We will explore the causes and consequences of large current account deficits later, but here it should be noted that a current account deficit is not simply a sign of weakness

Rapid economic growth in US raised income, increased spending power which means greater imports

CA: US Case

Foreign incomes did not rise as rapidly

Current account deficit in 1990s was a sign of relative US economic strength

Deficit is not sustainable in the long-run and could create serious future problems

Financial Account

Financial Account Basics

Main record of financial flows between countries

Covers all types of financial assets that can be bought and sold internationally

Divided into three main categories, each with many subcomponents.

The three main categories are:

The Net Acquisition of Financial Asset

The Net Incurrence of Liabilities

Changes in Financial Derivatives

Financial Account Basics

Assets include bank accounts, stocks and bonds, real property such as factories, businesses, real estate, and monetary gold and foreign currencies

Positive Net Acquisition of Financial Assets implies residents buying more foreign assets than they are selling

Positive Net Incurrence of Liabilities means foreigners purchasing more of home country’s assets than they are selling

Financial Derivatives are assets with a value that is derived from the value of some other asset

- Such as commodity prices or exchange rates, or one of many other possibilities

Financial Account: Derivatives

Essentially packaged as financial options (puts/calls) that allow for hedging against risk

For example, farmers used them to protect against fluctuations in agricultural prices

Wheat farmers might sign a contract in March to sell their crop in September at a price agreed when the contract is signed.

The value of the contract depends on the fluctuation in wheat prices.

If prices go above the agreed price, the contract becomes more valuable to the buyer because they have a guaranteed lower price, and vice-versa if prices fall over the summer

The contract is a derivative since its value depends on the price of wheat

Financial Account

Presents the flow of assets during the year and not the stock of assets that have accumulated over time

All flows are “net” changes rather than “gross” changes

Net changes are the differences between assets sold and assets bought, as when US residents purchase shares in the Mexican stock market while simultaneously selling Mexican bonds

Net change in US-owned assets is difference between the value of the shares purchased and the bonds sold

If the stocks and bonds are equal in value, then the net change is zero

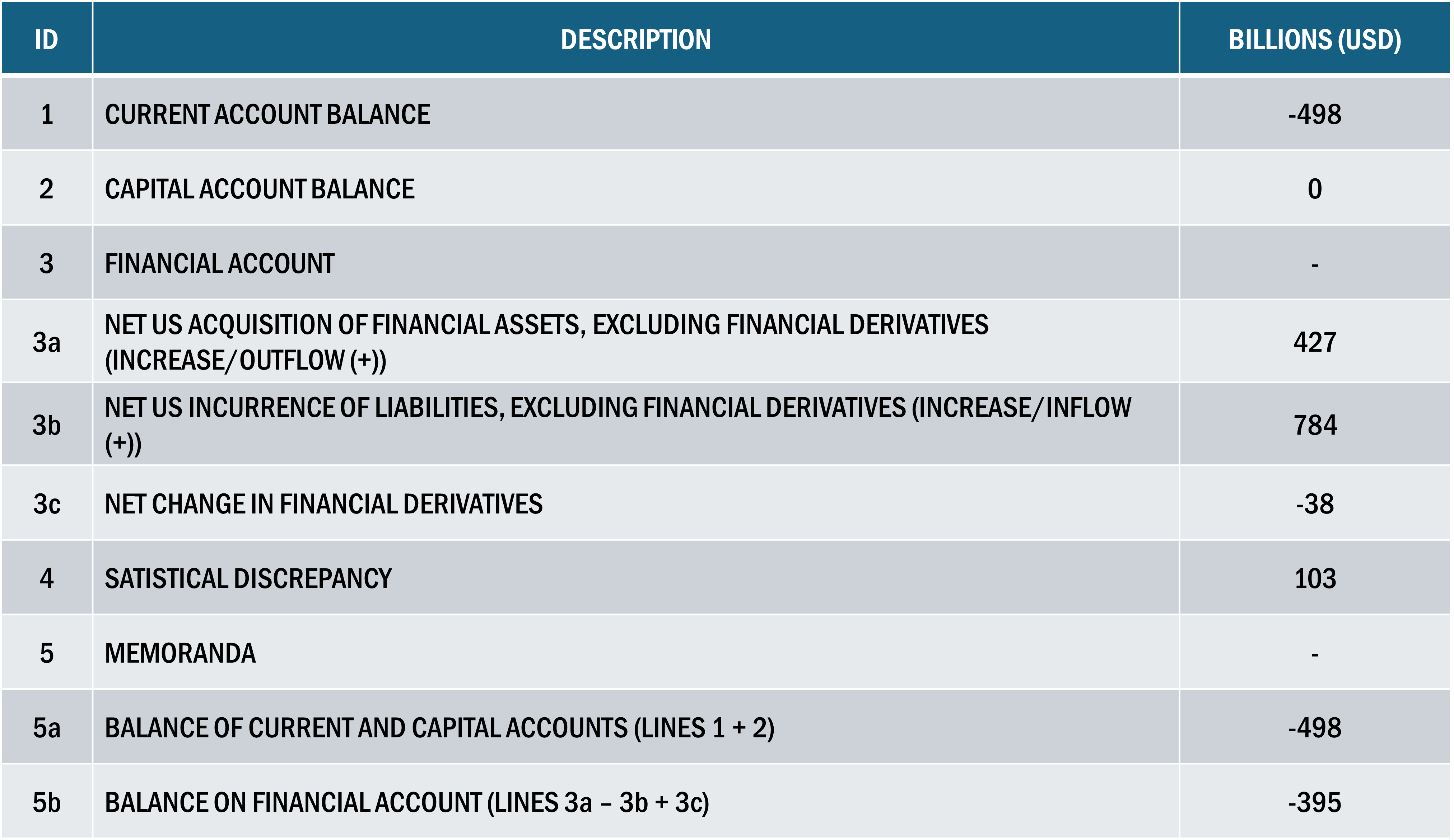

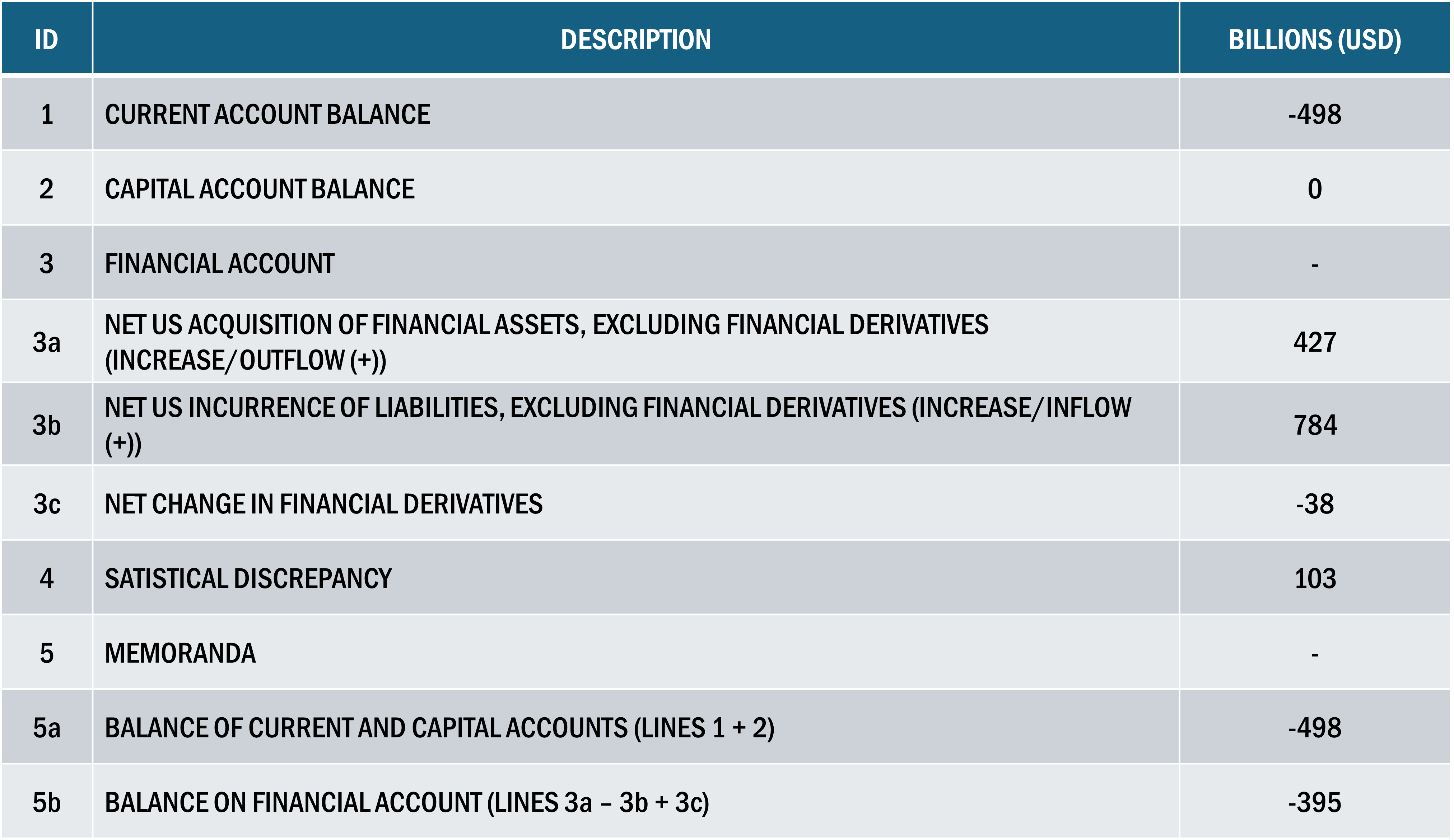

US Balance of Payments (2019)

Financial Account

Payments abroad to buy financial assets are a debit, as this represents an outflow of funds from the home country to purchase foreign assets.

- Debits are viewed as outflows of funds when home country residents purchase foreign assets.

Payments received from abroad for selling home country assets (net incurrence of liabilities) are a credit, as this represents an inflow of funds from foreigners purchasing domestic assets.

- Credits are viewed as inflows of funds when foreigners purchase home country assets.

Conceptually similar to the credits and debits of exports and imports

Interdependence

Interdependence

The Current, Capital, and Financial Accounts are interdependent

The Current and Capital Accounts measure the flows of goods, services, and transfers between a country and the rest of the world

The Financial Account measures the net flows of asset purchases and sales

Since each element in the Current Account must include a financial transaction:

- Current plus Capital Account must equal the Financial Account

Interdependence of Accounts

A negative Current Account plus Capital Account means the home country is spending more than it is earning from abroad, leading to a need for external financing

- This net borrowing shows up in the Financial Account, which tracks the flow of financial capital in and out of the country

Example: US in 2019

- Net Acquisition of Financial Assets (lent abroad): $427 bn

- Net Incurrence of Liabilities (borrowed from foreigners): $784 bn

- Net Change in Derivatives: -$38 bn

Balance on the Financial Account

\[\begin{align*} \text{Financial Account } &= \text{Net Acq. of Assets } - \text{Net Inc. of Liabilities} + \text{Net Change in Derivatives} \\ \text{Financial Account } &= 427 - 784 + (-38) = -395 \text{ billion} \end{align*}\]

Statistical Discrepancy

Why is Current + Capital \(\; \neq \;\) Financial?

Statistical Discrepancy

Why is Current + Capital \(\; \neq \;\) Financial?

It is impossible to record all transactions and ensure that they are accurately measured

The amound of net lending or borrowing on the current and capital accounts rarely matches the amount implied by the financial account balance

The Statistical Discrepancy is the size of the measurement error

While the Current and Financial Accounts are mirror images of each other, a large share of a nation’s gross financial account transactions is not in response to the current account of flows of goods, services, or income

Discrepancy Example

Suppose a London-based company buys stock in a Chilean firm, and lends money to the government of Thailand

Note: This has nothing to do with the movements of goods and services. These are purely financial transactions and must have a net value of zero.

Net value of zero is because the purchase of an asset is simultaneously the sale of an asset of equal value

- If a Canadian citizen buys shares in the Mexican stock market (capital outflow), they must sell Canadian dollars or some other asset (capital inflow)

As a result, the financial account is a complete picture of net flows of financial assets during the year

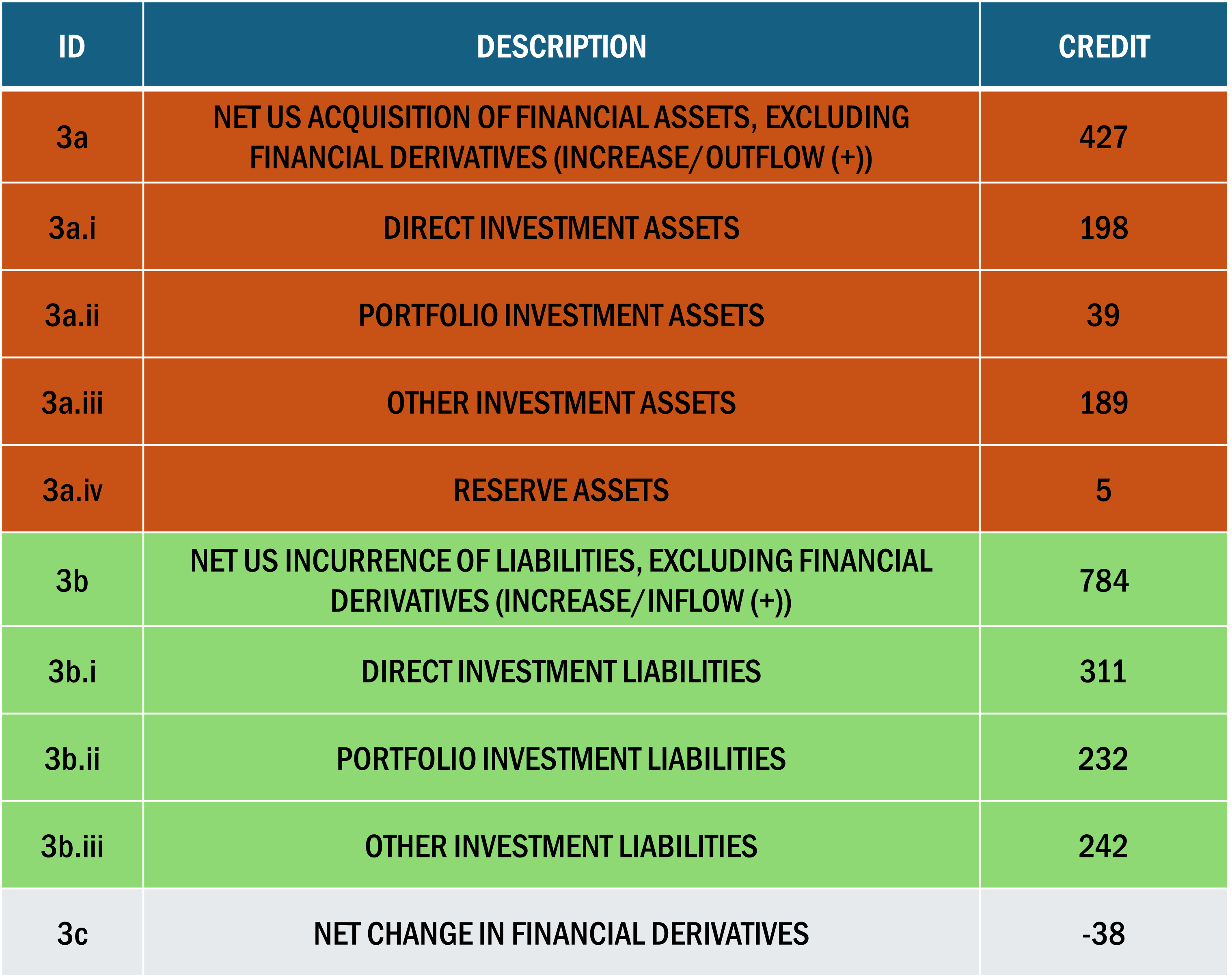

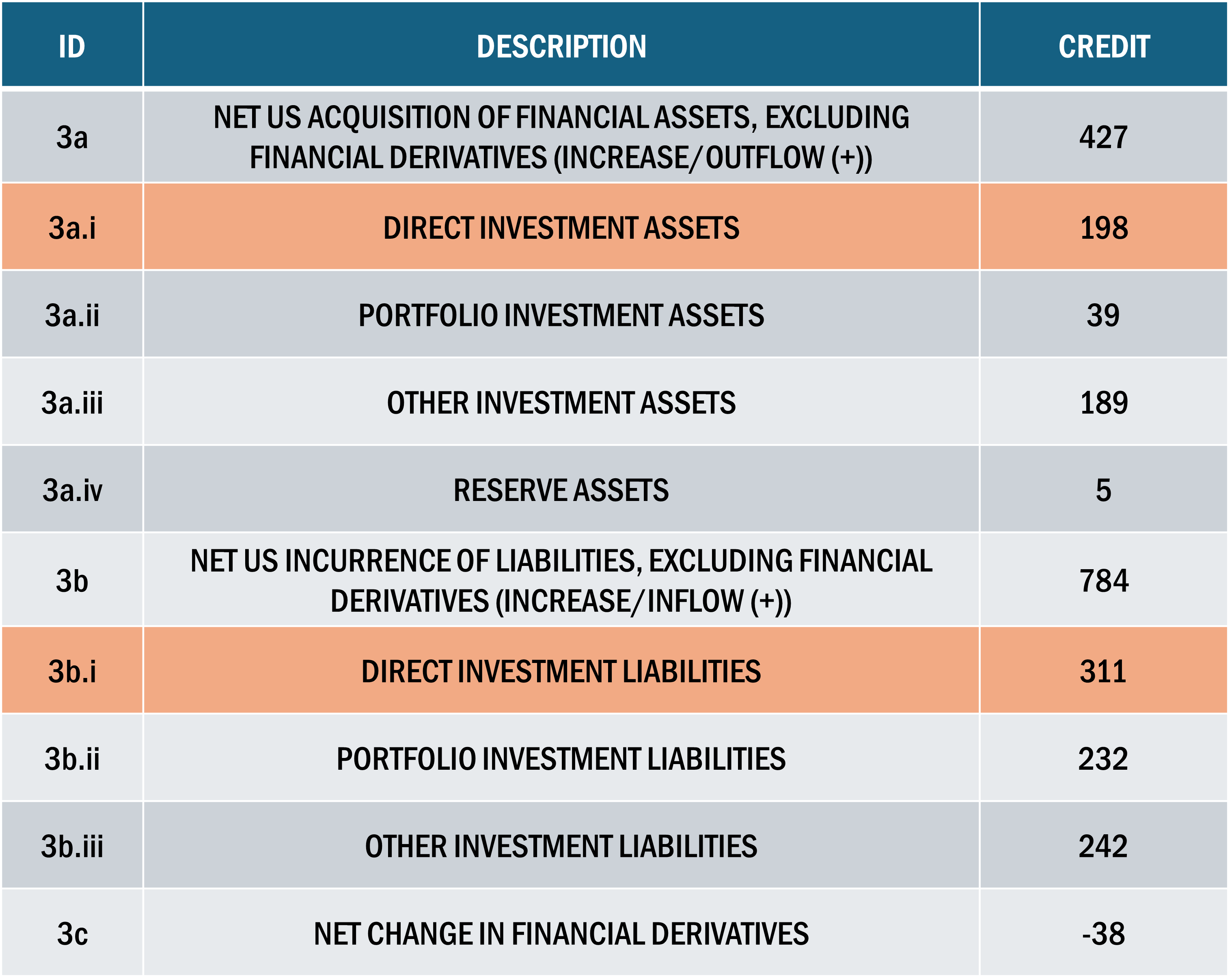

Financial Subcomponents

The 2019 financial account for the US, divided into seven subcategories representing the main components of outflows and inflows, or net assets acquired (outflow) and net liabilities incurred (inflow)

Financial Subcomponents

3a.i represents the purchase of real property outside the US by US residents and business

3b.i represents asset purchases in the US by foreign residents and businesses

Financial Subcomponents

In general, FDI varies considerably and is often linked to mergers

Once made, however, FDI is probably less likely to leave a country, particularly when compared to the next category of items in lines 3a.ii, 3a.iii, 3b.ii, 3b.iii

Summary

Recapping

Contents of Balance of Payments indicate net flows

Financial Accounts should balance with Current + Capital

Next time

Macroeconomy implications of BoP state

International Debt considerations

Investment Position

Introduce Exchange Rates

EC380, Lecture 07 | Balance of Payments I