Global Finance | Balance of Payments II

EC 380 - International Economic Issues

2025

Recap

Previously

Contents of Balance of Payments

Financial Account Features

Today

National Savings

International Debt

Limits on Financial Flows

Last time we discussed financial account flows

A trade-off exists with respect to allowing greater financial flexibility and increased exposure to international financial crises/capital flight

Countries risk becoming reliant on external sources of liquidity

A quick change in the business cycle could result in a large-scale exodus of liquidity

Asset prices drop, indebtedness intensifies

National Accounts

National Accounts + Deficit

National Income and Product Accounts (NIPA)

Gross Domestic Product (GDP): Value of all final goods and services produced inside its borders during some time period

Gross National Product (GNP) Value of all final goods and services produced by the labor, capital, and other resources of a country, regardless of where production occured

\[\begin{align*} GNP = GDP &+ \text{Foreign Income Received} \\ &- \text{Income Paid to Foreigners} \\ &+ \text{Foreign Tranfers Received} \\ &- \text{Transfers Paid to Foreigners} \end{align*}\]

National Accounts + Deficit

We can write our GNP formula as:

\[ GNP = GDP + (\text{Net Primary Income} + \text{Net Secondary Income}) \]

From standard macro models we know that:

\[ GDP = C + I + G + X - M \]

\[\begin{align*} \text{GNP} = C + I + G + \underbrace{(X - M + \text{Net Primary} + \text{Net Secondary})}_{\text{Current Account}} \end{align*}\]

GNP is also the value of income received

National Accounts + Deficit

GNP is also the value of income received

Individuals may consume income (C), save it (S), or use it to pay taxes (T)

In reality, we do a combination of all three

\[ \text{National Income} = GNP = C + S + T \]

If we set output equal to income:

\[ C + I + G + CA = C + S + T \;\; \Rightarrow \;\; I + G + CA = S + T \]

\[ S + (T - G) = I + CA \]

Supposing we have a balanced government budget, savings are equal to total investment in the country plus current account net flows

National Savings

A nation’s savings (private plus public) are divided into two uses

Source of funds for domestic investment

- If government budgets are in deficit, overall Left-hand side goes down, and all else being equal, investment falls

- Government budget surplus increases the funds available for investment

Source of funds for foreign investment

- If CA surplus, its national savings exceed domestic investment, and the surplus finances the purchase of domestic goods by foreign buyers.

- In return, the domestic economy acquires foreign financial assets, as it effectively lends to the rest of the world.

National Savings

Recall financial account reflects the same amount of lending or borrowing as CA

If \(CA < 0\), financial account features net borrowing greater than net acquisition of financial assets (lending, or financial outflows)

- Negative current account \(\Rightarrow\) net borrowing in the financial account, inflow of financial capital

- Surplus countries provide savings to the rest of the world, enabling sale of more goods abroad than they buy

- Financial capital outflow is investment because it involves acquisition of assets that are expected to pay a future return

National Savings

Because of this, another name for the current account balance is net foreign investment

A negative current account balance means that foreigners are acquiring more assets in the home country than the home country’s residents are acquiring abroad.

The US has had a CA deficit every year since 1981. Financial crisis of 2007-2009 had a dramatic effect on savings, investment, and government budgets

Savings rose, investment fell. Federal budgets fell into large deficits. Falling import levels represented an improvement in the CA balance

Current Accounts

Current Account Deficit

All of this begs the question:

Are Current Account Deficits Harmful?

The relationship between the current account balance, investment, and total national savings is an identity

It does not tell us why economy runs CA deficit or surplus.

It is just a relationship that must be true.

\[ S + (T - G) = I + CA \]

We cannot say CA is in deficit because saving is too low any more than we can say it is because investment is too high

Current Account Deficit

It is a general tendency in the media and public discourse to interpret a CA deficit as a sign of weakness and harmful to the nation’s welfare

A deficit enables more investment than would be possible otherwise (higher investment \(\Rightarrow\) higher living standards)

Capital inflows associated with current account deficits can be thought of as an implicit vote of confidence by foreigners

Current Account Deficit

For example, between 1980 and 1991, Japan invested over $25 billion of their trade surplus in US manufacturing industry

By the early 90s, they were employing more than 100,000 US workers. Investment came during major domestic layoffs.

Japanese firms acquired capital, built new plants with Japanese savings

During the US CA deficits of the 1990s, foreign investors continued to pour in capital, enabling increased productivity despite declining savings rate

CA deficit enabled more investment than was possible otherwise

Current Account Deficit

CA deficits can also generate problems

Capital inflows that occur with CA deficit increase the stock of foreign-owned assets in the home country

- Home country is now far more exposed to foreign policy/foreign business cycle conditions

- A sudden change in investor expectations about the home country’s future or their country’s prospects can lead to a sudden surge in capital outflows

- In a worst-case scenario, capital flight is followed by a depletion of international reseves and a financial crisis

Current Account Deficit

This is an experience shared by a number of developing countries since the 1980s

Deficits allow countries to invest more, huge opportunity for developing countries where investment capital is scarce

International financial crises, similar to biological diseases, tend to be contagious

When Mexico slipped into the peso crisis in late 1994 and early 1995, economists began to write about a “Tequila Effect” on Latin America.

When Thailand’s currency lost a large share of its value in 1997, media reported the crisis spreading across East Asia.

In both cases, the size of a country’s CA balance were not good predictors of whether it was drawn into the crisis

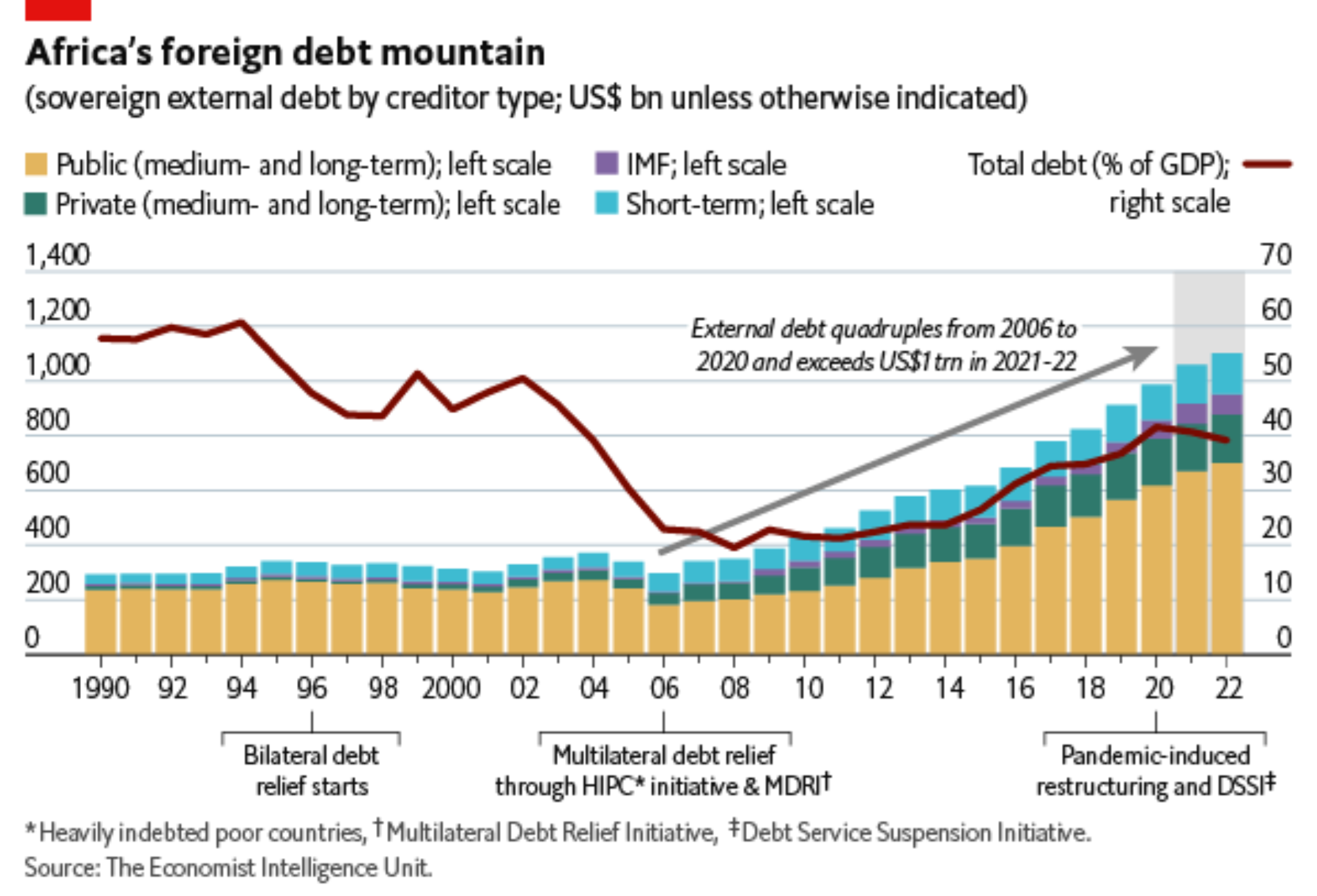

International Debt

International Debt

CA deficits financed through inflows of financial capital

Capital inflows take different forms, from direct investment to purchases of stocks, bonds, and currency, to loans

Loans from abroad add to a country’s stock of external debt and generate debt service obligations

External debt is defined as a debt that must be paid in a foreign currency

International Debt

When debt service becomes an unsustainable burden, it holds back economic development

International Debt

Most countries, rich and poor, have external debt

In high-income countries, debt service is rarely an issue

Usually relatively small compared to the size of the economy.

They are able to borrow in their own currencies

Low- and middle-income countries are another matter

- Size of the external debt burden can easily be unsustainable, given the economy’s ability to make interest payments and to repay the principle

Principle is the original amount borrowed to be repaid, excluding interest

International Debt

Unsustainable debt occurs for many reasons

Sometimes, countries are dependent on exports of one or two basic commodities such as copper or coffee

Shock of a sudden drop in world commodity prices reduces value of exports and generates unexpectedly large current account deficits

In other cases, countries experience natural disasters

Corruption can also play a role, as autocrats empty out national coffers

Even electoral politics may be a factor. When officials try to gain support through unsustainable expenditures targeted at important constituents

International Debt

Drawbacks of International Debt

Worsens budget position by adding replayments made to outsiders

- It reduces the availability of public funds for important domestic needs such as infrastructure, schools, and health care

- In addition, many examples of excessive debt burdens that have spiralled, intensified, and spread economic crises

Summary

- National Accounts and CA balance are interconnected

- Deficit is not a sign of economic/geopolitical weakness

- A deficit implies borrowing from abroad, but investments can be very fruitful

EC380, Lecture 08 | Balance of Payments II