Global Finance | Exchange Rates LR

EC 380 - International Economic Issues

2025

Recap

Previously

National Accounts and CA balance are interconnected

Deficit is not a sign of weakness

A deficit implies borrowing from abroad, and these investments can be very fruitful

Today

- Exchange Rate Adjustments

Basics

Starting From The Start

What is an exchange rate?

This is the exact amount of one currency received in exchange for a single unit of an alternative currency

The US-Costa Rica exchange rate can be expressed as either:

How many US Dollars do I get for each Colon exchanged?

How many Colones do I get for each US Dollar exchanged?

Usually we see the rates that do not account for transaction fees

Basics

We are usually told one unit of this currency is equal to x units of the other

For example, suppose one US dollar can be exchanged for 510.06 colones

\[ \text{USD to Colon, Nominal Exchange Rate} \]

\[ \dfrac{\text{Units of Exchange Currency}}{\text{Units of Held Currency}} = \dfrac{\text{Colones}}{USD} = \dfrac{510.06}{1} \]

Basics

If you are given an exchange rate (1 USD for 510.06 colones), but are asked to find the exchange in the opposite direction you just have to invert the ratio

How many dollars can one colon be exchanged for at this rate?

\[ \text{Colon to USD} = \left(\dfrac{510.06}{1}\right)^{-1} = \dfrac{1}{510.06} \approx 0.002 \; \text{USD} \]

Individual units of colones are not worth very much, nominally, in terms of dollars

We cannot comment on colones being worth little though, since nominal wages in colones might be high

Basics

Key economic events can adjust the value of a currency relative to other items it trades against

When a home currency is able to purchase more units of a foreign currency:

- The home currency is said to have appreciated in value

When instead, the amount of foreign currency that one can buy with a single unit of home currency declines:

- The home currency is said to have depreciated in value

Basics

For example, if the USD:GBP exchange rate changed from 0.87 to 0.85, the units of GBP that each USD can be exchanged for has fallen

This implies that:

USD has depreciated in value, relative to the GBP \(\Rightarrow\) USD \(\downarrow\)

GBP has appreciated in value, relative to the USD \(\Rightarrow\) GBP \(\uparrow\)

Consider how you would calculate the GBP:USD exchange rate and the movements from there as well

Currency Exchanges

Currency Exchanges

All of the work on globalization and interconnectedness begs the question:

Why hold other currencies?

We will argue there are three reasons

1) Enable trade and investment purposes

Traders (importers and exporters) and investors routinely transact in foreign currencies, either receiving or making payments in another country’s currency.

Tourists are included in this category because they have to participate in foreign exchange in order to buy foreign goods and services

Currency Exchanges

All of the work on globalization and interconnectedness begs the question:

Why hold other currencies? We will argue there are three reasons

2) Interest Rate Arbitrage

Arbitrage conveys the idea of buying something where it is relatively cheap and selling it where it is relatively expensive

Arbitrageurs borrow money where interest rates are relatively low and lend it where rates are relatively high

This keeps interest rates from diverging too far and also constitutes one of the primary linkages between national economies

Currency Exchanges

All of the work on globalization and interconnectedness begs the question:

Why hold other currencies? We will argue there are three reasons

3) Speculative Action

Speculators are businesses that buy or sell a currency because they expect its value to rise or fall

They have no need for foreign exchange to buy goods/services or financial assets; rather, they hope to realize profits or avoid losses through correctly anticipating changes in a currency’s market value

If speculators view currency as overvalued, they will sell it and drive down its value.

If they guess wrong, however, they can lose a lot of money

Currency Speculation

This is a point of contention

Not everyone agrees that currencies should be traded speculatively, due to panics these actions can trigger en-masse

Speculation against currency can be destabilizing and sometimes lead to grossly over- or under-valued currency which is a major problem for that country

Currency Exchanges

There are three main participants in foreign currency markets:

Retail Customers:

Includes any firms/individuals that hold foreign exchange to engage in purchases, to adjust their portfolios, or to profit from expected future currency movements

Usually buy and sell through a commercial bank

Currency Exchanges

There are three main participants in foreign currency markets:

- Retail Customers

Commercial Banks:

Hold inventories of foreign currencies as part of services offered to customers. Usually have relationship with several foreign banks where they hold their balances of foreign currencies

When a surplus accumulates or a shortage of funds develops, the banks trade with each other to adjust their holdings

Not very common for US banks to trade currency with foreign banks, they tend to use foreign exchange brokers

Currency Exchanges

There are three main participants in foreign currency markets:

Retail Customers

Commercial Banks

Foreign Exchange Brokers:

Middlemen between buyers and sellers that do not usually hold foreign exchange

Brokers can also serve as agents for central banks

Foreign Exchange Brokers

Here’s how it works:

- An individual or firm that needs foreign exchange calls its bank

- The bank quotes a price at which it will sell the currency

- The price is based on either:

- Bank having an account with the bank in the foreign country where currency is used

- Rate from foreign exchange broker

- Broker keeps track of buyers and sellers of currencies and acts as deal maker

Foreign Exchange Market

Exchange Rate Risk

Multinational firms face risks in terms of market performance and value of revenue, given any degree of exchange rate volatility

Contracts defined in nominal foreign currency amounts face an uncertainty regarding how much these costs will scale or deflate reaching a payment date

The market is extraordinarily good at finding ways to mitigate risk, when possible

Exchange Rate Risk

The markets’s answer: Forward Exchange Rates

The forward exchange rate sets the price of currency that will be delivered in the future and these transactions take place on the forward market

Spot market represents any buying and selling taking place in the present

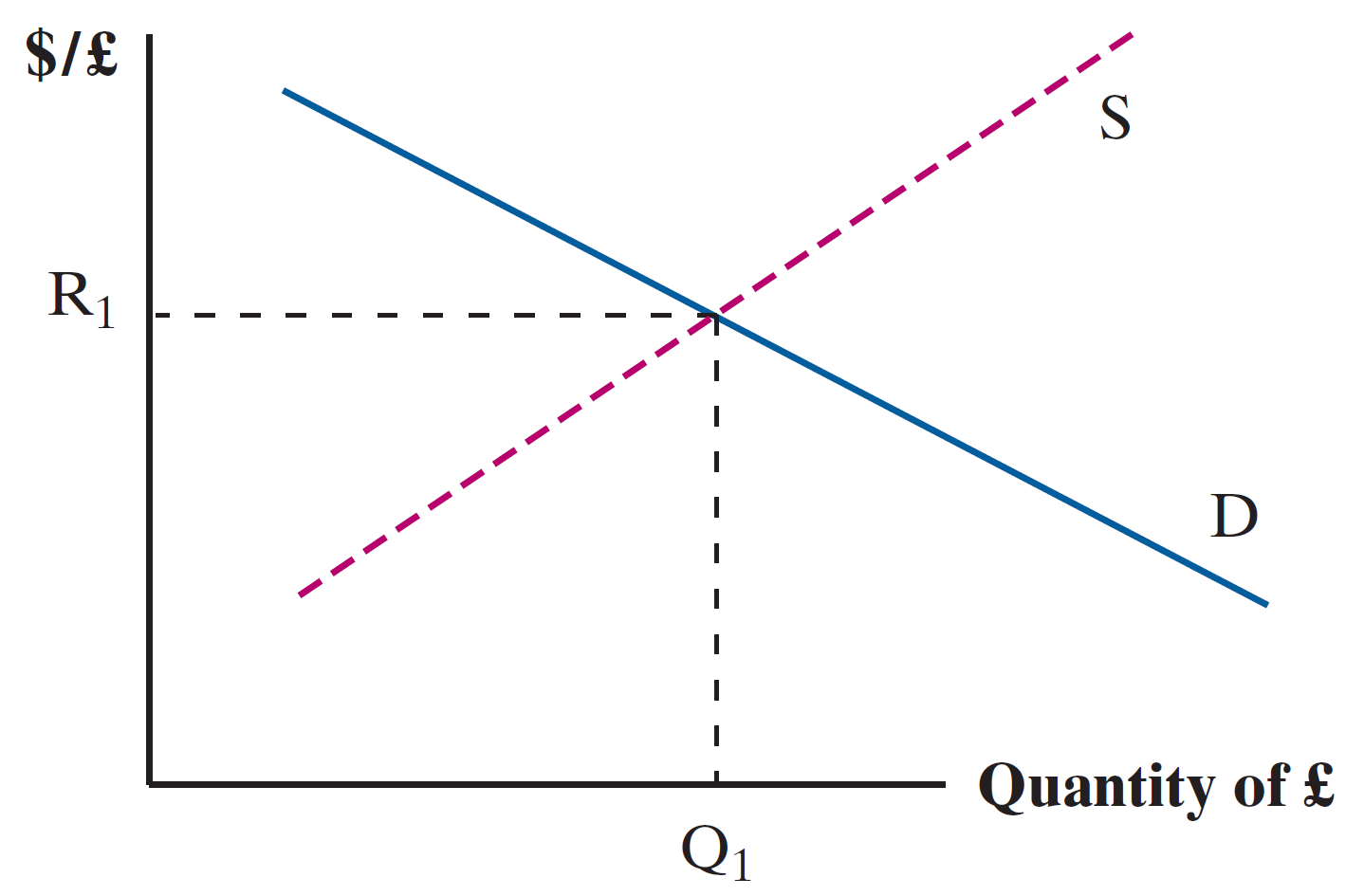

Effects of \(\Delta\) Supply and \(\Delta\) Demand of Foreign Currency

Let’s take the market for GBP

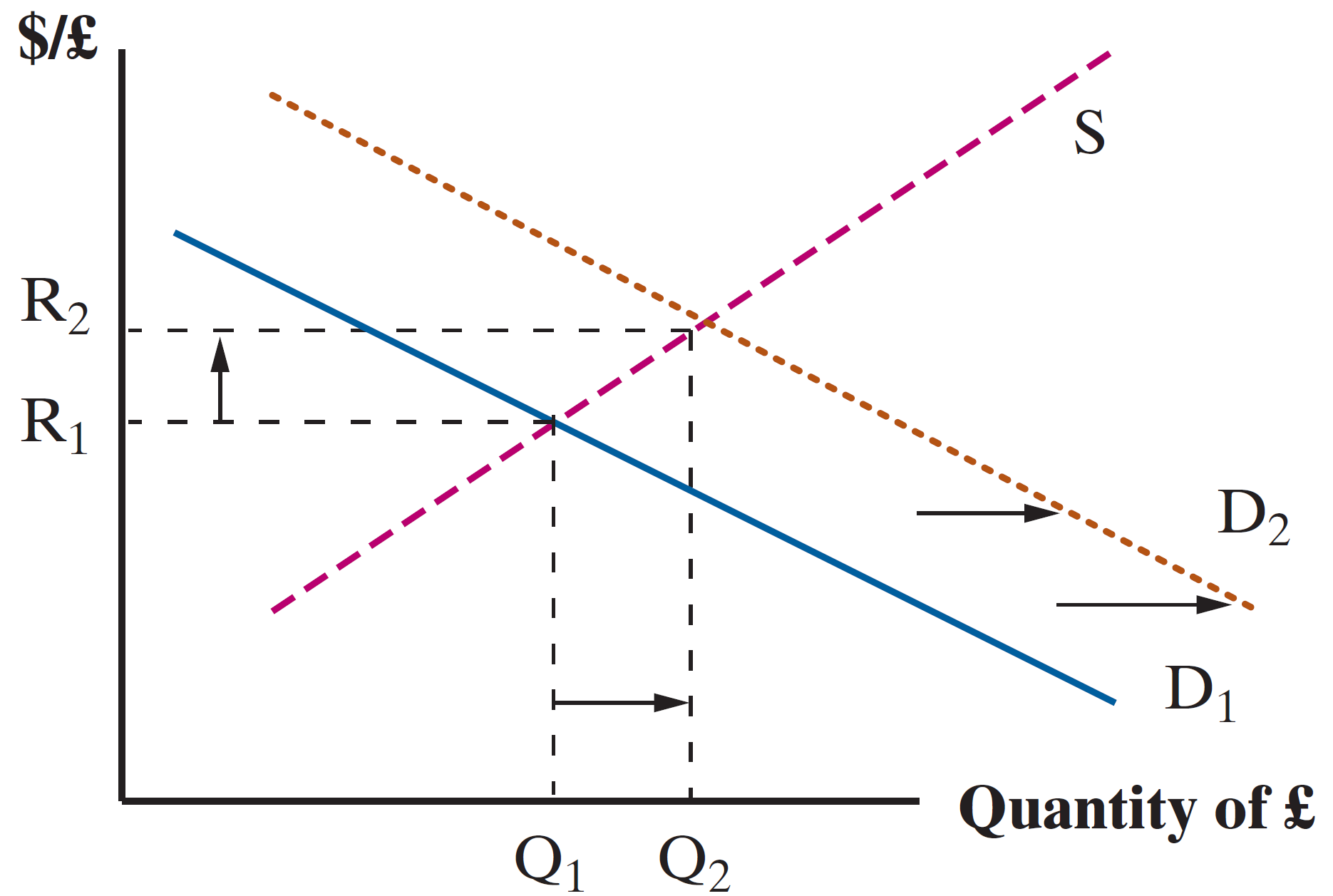

Increased Demand for GBP

Raises its price

- It appreciates

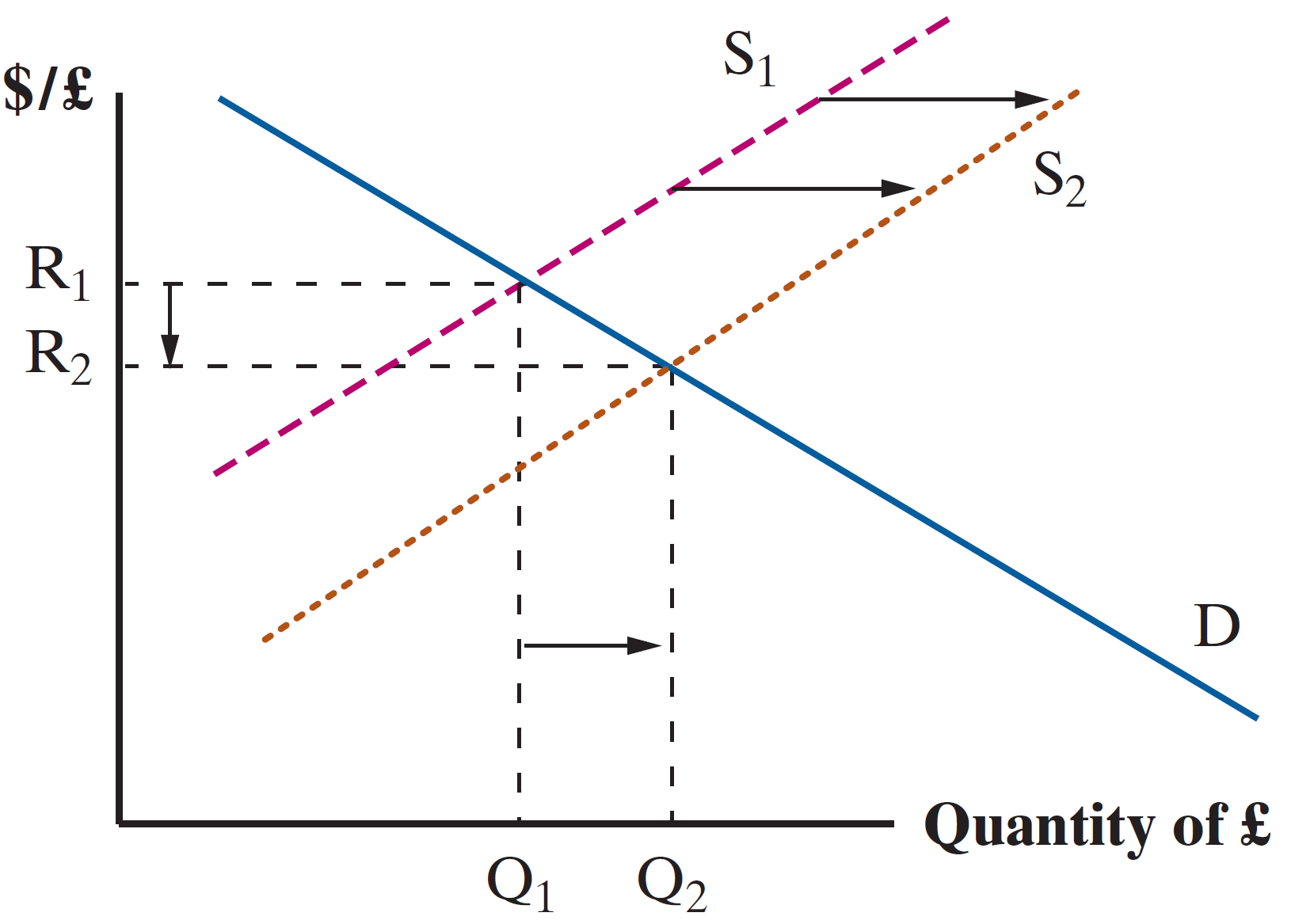

Increased Supply for GBP

Lowers its price

- It depreciates

Under a fixed exchange rate system, values of USD is held constant through actions of the Central Bank that counteract market forces

Supply and demand analysis is a useful tool for understanding the pressures on a currency regardless of the type of exchange rate system adopted

We will begin with the assumption that exchange rates are completely flexible

FX Market: Flexible

FX Market: Flexible

FX Market: Flexible

FX Market: Long Run

In the extreme case, long-run exchange rates should see all arbitrage opportunities eliminated

This will lead to bids for currencies playing out until the purchasing power of a specific amount of a given Home Currency will be equal to the purchasing power of its foreign currency exchanged when spent abroad

This concept of equal purchasing power internationally for the same basket of goods is called purchasing power parity (PPP)

In the short-run, differences in purchasing power for the same bundle of goods exist

Purchasing Power Parity Example

PPP Example

Suppose a bag of goods costs 1000 USD and 800 GBP

According to PPP, the exchange rate is $1.25 dollars to the pound

Imagine that GBP:USD is $2.

Goods priced at 800 GBP in UK sell for 500 GBP if imported from the US and paid for in USD

This presents an Arbitrage Opportunity

- Brits begin exchanging GBP for USD

- Demand increases for USD (Appreciation)

- New equilibrium settles where purchasing power parity is achieved

PPP Example

An unrealistic assumption that we will make (consider this a caveat)

- Assume that goods flow without cost across international borders and that all goods and services can be traded

In reality, there are transportation costs involved with moving goods. And some goods and services are not able to be traded

- Bank fees for a currency broker when buying the needed pounds

- Some of the goods and services are non-tradable, arbitrage is not possible

Also, few nations have eliminated all their barriers to entry of foreign goods and services

PPP in the Long-Run

Evidence shows that PPP exerts its influence over exchange rates only in the long-run

Over time we have:

- Lower transport costs

- Minimized import rules

- Minimized regulations

Summary

Recap

Exchange rates determine price of foreign goods

Numerous reasons to hold foreign reserves

Shifts in exchange rates often mirror changes in demand and supply of currencies

PPP holds only in the Long-Run

Next

- Short-run & Medium-Run Exchange Rates

- Parity Relationships

EC380, Lecture 09 | Exchange Rates LR