Global Finance | Exchange Rates Short & Medium Run

EC 380 - International Economic Issues

2025

FX Medium & Short-Run

FX Market: Medium Run

Consider it to be typically a 4 to 5 year range, where countries experience ebbs and flows of business cycle booms and busts

Consider the US economy going through a business cycle boom

During boom periods, incomes go up, aggregate demand of goods/services rises across consumers

A part of that will lead to increased demand for imports

This implies a greater need for foreign currency (to purchase imports)

FX Market: Medium Run

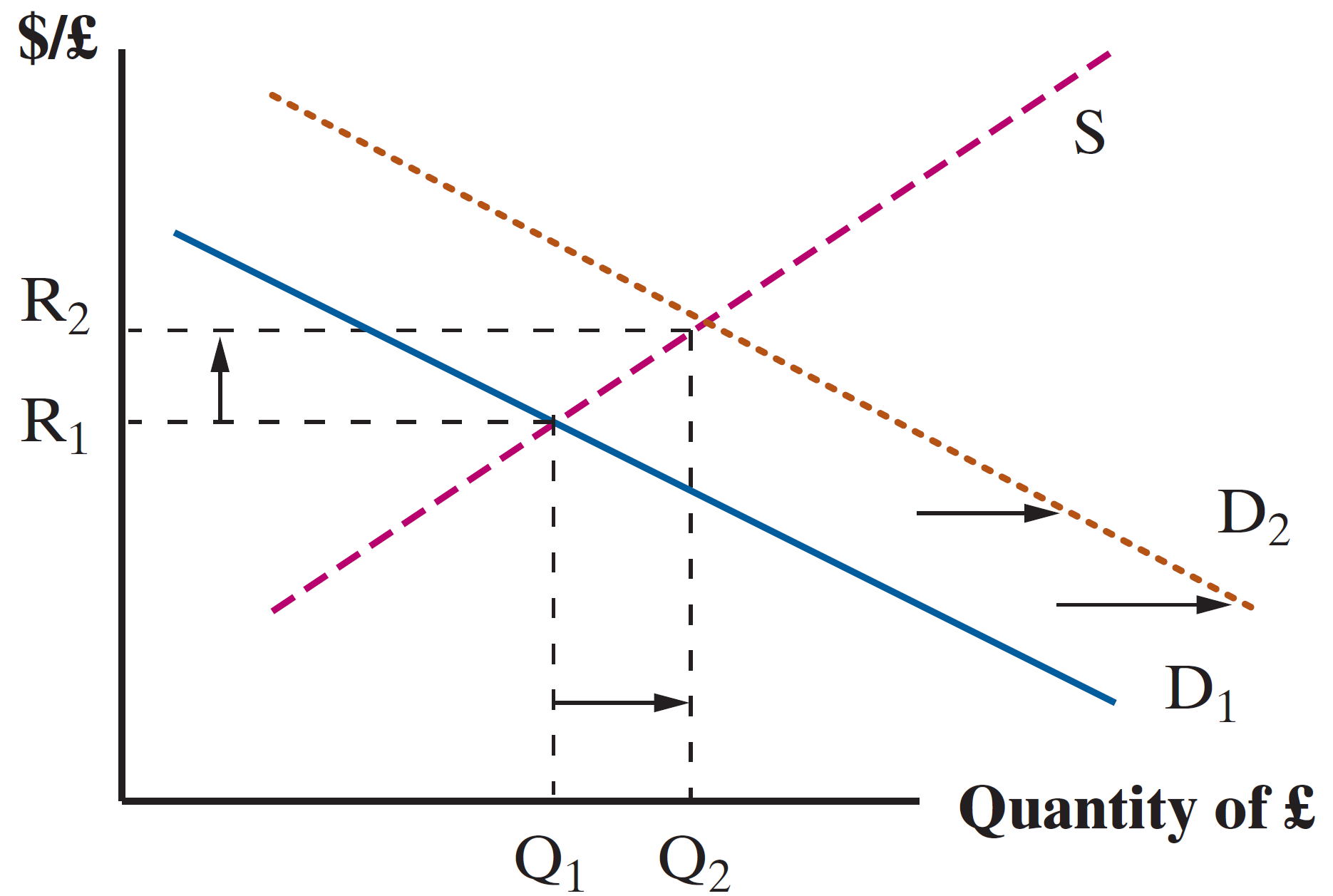

US incomes increase, demand for UK imports increases, so demand for GBP increases

FX Market: Short Run

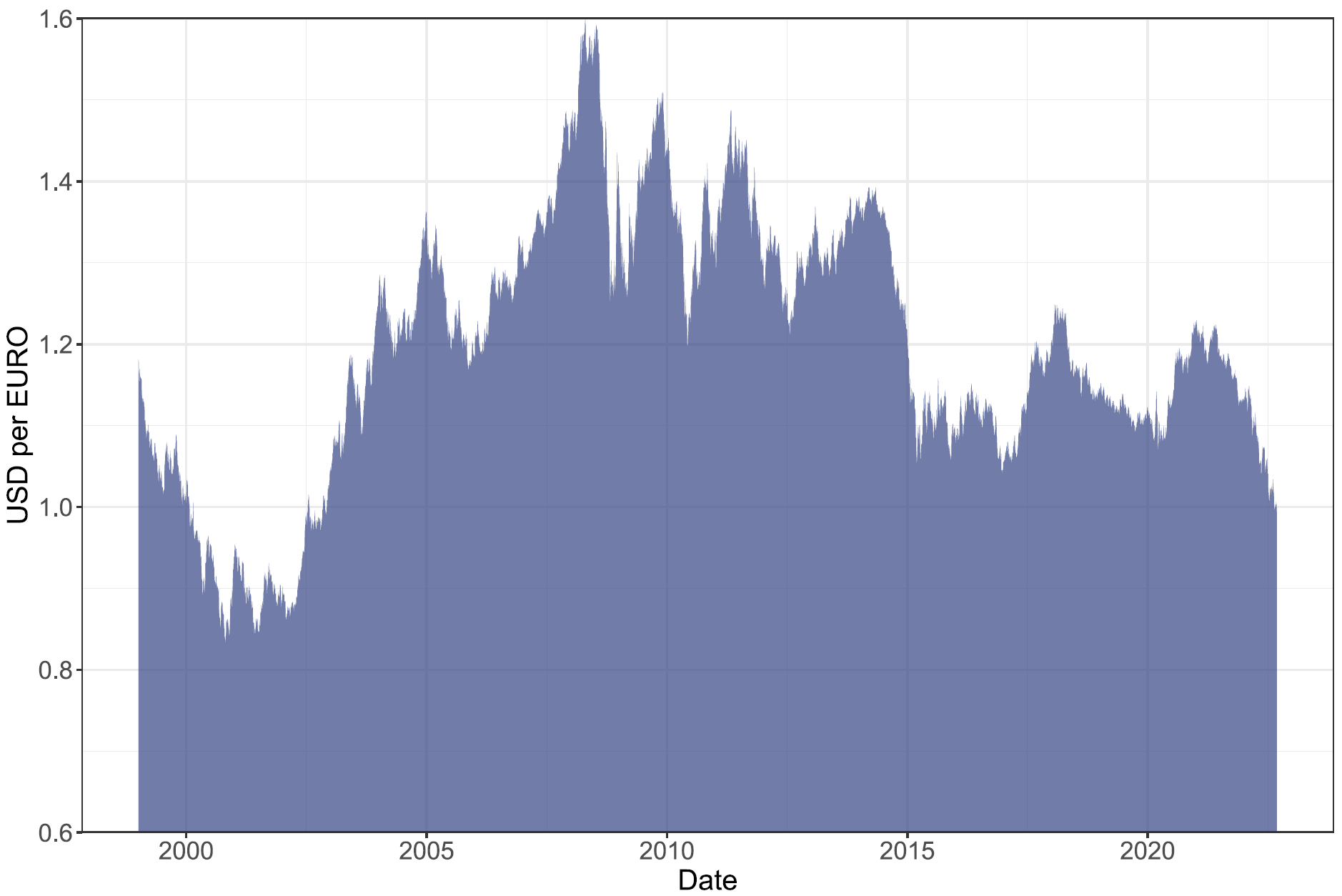

The Short-Run will look relatively more chaotic

We will consider the Short-Run to be a time period of one year or less

We observe continuous day-to-day fluctuations in exchange rates

FX Market: Short Run

So what causes short-run changes in Exchange Rates?

- Interest rate adjustments, which can occur 4-5 times in a year

- Speculation, driven by exogenous shocks to the state of the economy

- Political scandals

- Discovery of natural gas deposits

- COVID outbreak

The latter contributes to a mechanism known as price discovery in exchange rates

FX Market: Short Run

Price Discovery is the trial-and-error process of discovering the equilibrium price in a market

If speculators believe a currency is overvalued, they sell that currency, driving its value down

If correct, currency moves towards an equilibrium and speculators are rewarded through arbitrage profits

If wrong, large losses are realized. This can often lead to bankruptcy if these risks were taken based on borrowed funds

These high stakes create a strong incentive to make the correct decision, bolstering the speed of market adjustments in the process

Interest Parity

FX Market: Interest Parity

Interest Parity Condition: Difference between the home and foreign interest rates should be equal to the expected change (appreciation or depreciation) of the exchange rate

\[ i - i^{*} = \dfrac{(F - R)}{R} \]

- \(i\) is the home interest rate

- \(i^{*}\) is the foreign interest rate

- \(F\) is the expected future exchange rate

- \(R\) is the current exchange rate

FX Market: Interest Parity Example

Suppose an investor has the choice to either invest locally or invest abroad in one-year bonds

More generally:

X year bond: After maturing for X years, the bond is paid back to the investor in full principal amount and includes a yield of interest accrued for X years

A bond will have the payoff equal to:

\[ P \times (1 + i)^{n} \]

Where \(P\) is the principal amount invested, \(i\) is the interest rate, and \(n\) are the years the bond accrues interest for before maturing

FX Market: Interest Parity Example

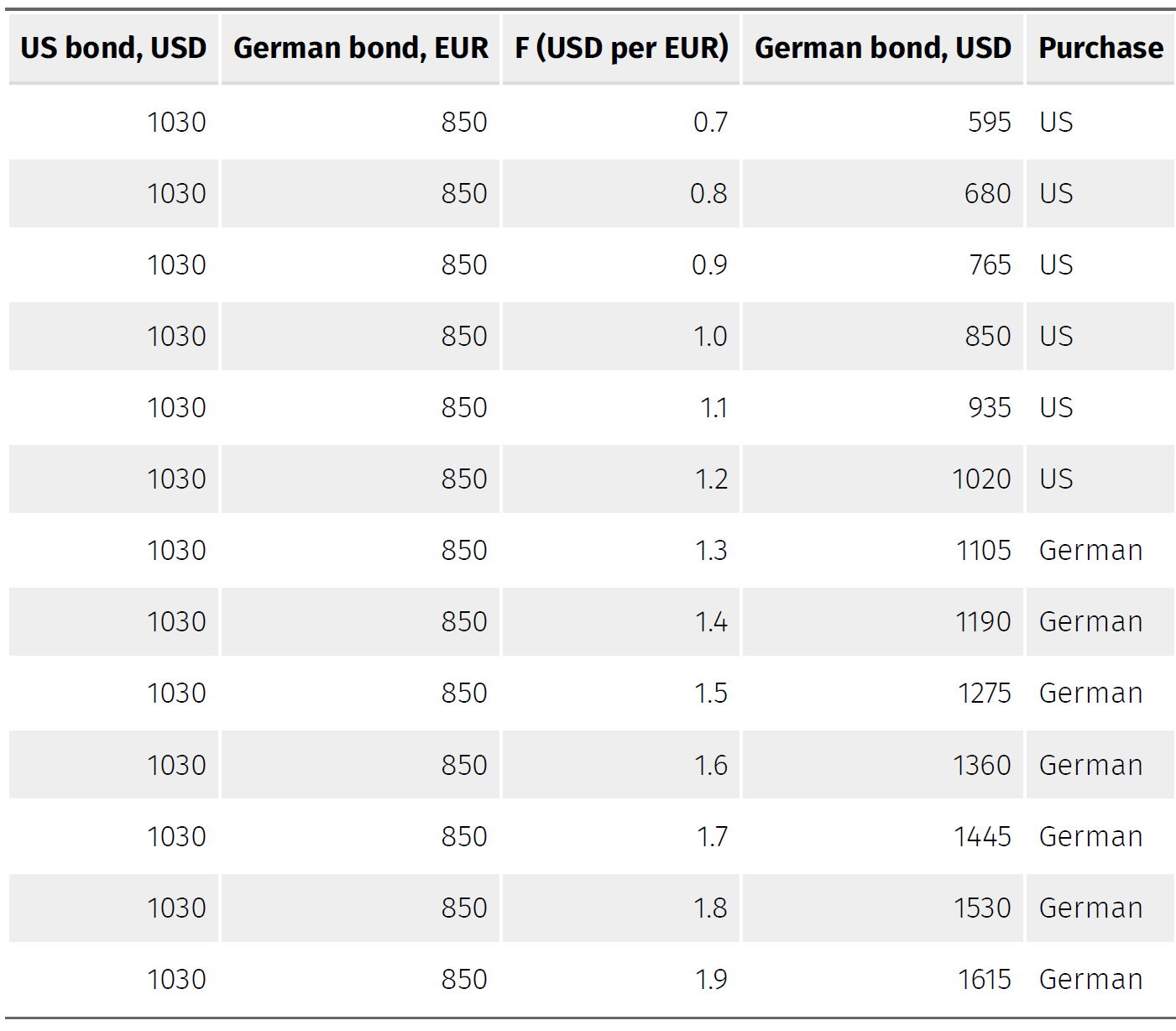

Suppose an investor is weighing the choice between a 1-year US bond and a 1-year German bond

They both are at the price of 1000 USD

The respective rates of return are \(i = 0.03\) (US) and \(i^{*} = 0.02\) (GER).

Each payoff is in its respective currency

\[ \text{US bond} = 1000 \times (1.03)^{1} = 1030 \text{ USD} \]

The German Bond requires more careful thought

FX Market: Interest Parity Example

A German Bond would be paid in euros, so we have to consider exchange rates to compare them

Recall the German Bond pays an interest equal to 0.02 (2%) in euros

The dollar value of this investment choice depends on the future exchange rate one year from now

Suppose the exchange rate today is 1.2 USD per EUR

Investor can buy 833.33 EUR in exchange for 1000 USD

\[ \text{EUR bond} = 833.33 \times (1.02)^{1} = 850 \text{ EUR} \]

FX Market: Interest Parity Example

To accurately compare the two choices, the investor must forecast the exchange rate in one years time

- We denote this as \(F\)

- If the expected future exchange rate E(F) is \(E(F) = 1.3 \text{ USD/EUR}\)

- Implies an expected foreign value of \(850 \times 1.3 = 1105 \text{ USD}\)

- The US Bond is worth \(1030\), so the foreign return of \(1105\) is more profitable

- The expected return of foreign investment is:

\[ i^{'} = \left[\dfrac{E(F)}{R} \times (1 + i^{*}) \right] - 1 \]

FX Market: Interest Parity Example

To guarantee \(E(F) = F\) is to remove the uncertainty from the setting

Hedge against exchange rate risk by signing contracts on the forward exchange rate market

Today’s spot rate \(R\) and market rate on one-year exchanges \(F\) indicate where the market sees the Exchange Rate moving in one year

If \(F > R\), the currency is expected to depreciate

If \(F < R\), the currency is expected to appreciate

FX Market: Interest Parity Example

In our example, investors were willing to sell off US Bonds in order to purchase German Bonds

- Funds will flow from the US to Germany, causing German Money Supply to increase

- A greater money supply implies lower interest rates, so \(i^{*}\) falls

- Demand for German Currency used to buy the bonds rises, so \(R\) rises

- Market moves towards interest rate parity

\[ i - i^{*} = \dfrac{(F - R)}{R} \]

FX Market: Interest Parity

What happens when \(F\) changes?

The future dollar value of German Bonds in USD changes too

The scale and direction of the change dictate the choice investors make

Let’s see what this might look like

FX Market: Interest Parity

FX Market: Interest Parity

Note: The textbook does a good job at explaining all scenarios on p. 226-227

These mechanisms playout somewhat like a self-fulfilling prophecy

If investors think USD will depreciate in the future, \(F\) rises

This causes return on foreign bonds to improve, causing demand on foreign currency to rise and the dollar’s spot rate \(R\) depreciates

A change in expectations about future exchange rates can lead to a similar change in the spot rate

FX Market: Interest Parity

We can think about the market playing out in two manners

- Covered Interest Parity (CIP)

- Uncovered Interest Parity (UIP)

CIP & UIP

CIP and UIP

Covered Interest Parity (CIP)

- Assume the investor has perfect foresight such that \(E(F) = F\)

Uncovered Interest Parity (UIP)

- Assume investor accepts risk involved and purchases with E(F) in mind

FX Market: CIP

Investors will trade until returns from either bond equalize, and all arbitrage opportunities are exhausted

\[ \text{CIP: } (1 + i) = (1 + i^{*}) \dfrac{F_{\text{USD/EUR}}}{R_{\text{USD/EUR}}} \]

In that case, investors are indifferent between either bond since their real returns are the same

This allows us to pin down the \(F\) necessary to achieve CIP

\[ F_{\text{USD/EUR}} = R_{\text{USD/EUR}} \times \dfrac{1 + i}{1 + i^{*}} \]

FX Market: UIP

This alternative method of investment allows us to determine how spot rates are established

The no-arbitrage condition for UIP is written as:

\[ \text{UIP : } (1 + i) = (1 + i^{*}) \dfrac{E(F)_{\text{USD/EUR}}}{R_{\text{USD/EUR}}} \]

This lets us pin down the \(R\) necessary to satisfy UIP

\[ R_{\text{USD/EUR}} = E(F)_{\text{USD/EUR}} \times \dfrac{1 + i^{*}}{1 + i} \]

We can calculate today’s spot rate if we know market expected exchange rate and these two respective interest rates

FX Market: CIP & UIP

Taking both our previous equations, and dividing one into the other on both sides:

\[ \text{CIP: } (1 + i) = (1 + i^{*}) \dfrac{F_{\text{USD/EUR}}}{R_{\text{USD/EUR}}} \]

\[ \text{UIP : } (1 + i) = (1 + i^{*}) \dfrac{E(F)_{\text{USD/EUR}}}{R_{\text{USD/EUR}}} \]

\[ \Rightarrow 1 = \dfrac{F_{\text{USD/EUR}}}{E(F)_{\text{USD/EUR}}} \]

Under the assumption of both types of investors (risky and riskless) exhausting all arbitrage opportunities, expected exchange rates should be equal to forward exchange rates

Exchange Rate Example

Exchange Rates

Q. Consider the following demand and supply curves of foreign currency, where ExR represents the local currency to foreign currency (e.g. USD-GBP) exchange rate. FC represents the units of foreign currency reserves held in the “local” economy.

\[\begin{align*} D: ExR = 57 - 0.061FC \;\;\; ; \;\;\; S: ExR = 2 + 0.012FC \end{align*}\]

What is the market clearing rate of exchange and the associated level of foreign currency reserves?

Consider a case where the market anticipates a new technology being released abroad, which causes demand for foreing currency reserves to rise by 2 units, such that the new demand curve can be represented by \(D' = D + 2\). What are the new exchange rate and currency reserve values?

How would you describe the change in both currencies? Which has depreciated and which has appreciated?

Question 01

\[\begin{align*} D: ExR = 57 - 0.061FC \;\;\; ; \;\;\; S: ExR = 2 + 0.012FC \end{align*}\]

Find the equilibrium values of ExR and FC

\[\begin{align*} \text{Demand} &= \text{Supply} \\ 57 - 0.061FC &= 2 + 0.012FC \\ 55 &= 0.073FC \\ FC &= 753.42 \end{align*}\]

\[\begin{align*} ExR &= 2 + 0.012(753.32) \\ ExR &= 11.04 \end{align*}\]

Question 02

D’ = D + 2

\[\begin{align*} \text{New Demand} &= \text{Supply} \\ 57 - 0.061FC + 2 &= 2 + 0.012FC \\ 57 &= 0.073FC \\ FC &= 780.82 \end{align*}\]

\[\begin{align*} ExR &= 2 + 0.012(780.82) \\ ExR &= 11.37 \end{align*}\]

Question 03

How would you describe the change in both currencies? Which has depreciated and which has appreciated?

At first

\[\begin{align*} FC = 753.42 \; ; \; ExR = 11.04 \end{align*}\]

After change

\[\begin{align*} FC = 780.82 \; ; \; ExR = 11.37 \end{align*}\]

Foreign Currency has appreciated and Local Currency has depreciated

EC380, Lecture 10 | Exchange Rates SR/Medium