Theories of Growth & Development

EC 390 - Development Economics

2025

Goals

Look at economic theories/models to see what they can say about:

- What can be done to improve a country’s economic growth

- What changes to expect as a country develops

We will begin with growth models Factors that influence economic growth

Then cover contemporary models of development and underdevelopment (coordination failure)

Harrod-Domar Growth Model

Model 01 - Harrod-Domar

Savings drive growth

The more a country saves, the more it can invest in capital

To produce output, the only thing we need is capital

- We ignore labor

- Let’s start with the model assumptions

Harrod-Domar Assumptions

1. Net savings \((S)\) is a fixed proportion of national income \((Y)\)

2. A fixed amount of Capital \((K)\) is need to produce output

3. All new Investments \((I)\) is used to increase the Capital Stock \((K)\)

4. The savings-investment market clears

Harrod-Domar Assumptions

1. Net savings \((S)\) is a fixed proportion of national income \((Y)\)

\[\begin{align*} S = sY \\ 0 \leq s \leq 1 \end{align*}\]

2. A fixed amount of Capital \((K)\) is need to produce output

3. All new Investments \((I)\) is used to increase the Capital Stock \((K)\)

4. The savings-investment market clears

Harrod-Domar Assumptions

1. Net savings \((S)\) is a fixed proportion of national income \((Y)\)

2. A fixed amount of Capital \((K)\) is need to produce output

- Capital is a fixed proportion of output where \(c\) is a capital-output ratio

\[K = cY\] \[\Rightarrow c = \dfrac{K}{Y}\] \[\Rightarrow \Delta K = c \Delta Y\]

3. All new Investments \((I)\) is used to increase the Capital Stock \((K)\)

4. The savings-investment market clears

Harrod-Domar Assumptions

1. Net savings \((S)\) is a fixed proportion of national income \((Y)\)

2. A fixed amount of Capital \((K)\) is need to produce output

3. All new Investments \((I)\) is used to increase the Capital Stock \((K)\)

\[ I = \Delta K \]

4. The savings-investment market clears

Harrod-Domar Assumptions

1. Net savings \((S)\) is a fixed proportion of national income \((Y)\)

2. A fixed amount of Capital \((K)\) is need to produce output

3. All new Investments \((I)\) is used to increase the Capital Stock \((K)\)

4. The savings-investment market clears

- All savings are used as investment

\[ S = I \]

Harrod-Domar Growth Model

We are after the Growth Rate of Income (or production)

\[ \dfrac{\Delta Y}{Y} \]

- There are only 4 equations

- Algebra is easy once you know how and where you are going

Harrod-Domar Growth Model

Our 4 equations

1. \(S = sY\)

2. \(S = I\)

3. \(I = \Delta K\)

4. \(\Delta K = c \Delta Y\)

Show that \(\; sY = c \Delta Y\)

\(sY = S \Rightarrow\) \(sY = I \Rightarrow\) \(sY = \Delta K \Rightarrow\) \(sY = c \Delta Y\)

Harrod-Domar: Growth Rate of Output

Recall we want to find the Growth Rate of Income \(\dfrac{\Delta Y}{Y}\)

We can rearrange \(sY = c \Delta Y\) to get it

\[ \dfrac{\Delta Y}{Y} = \dfrac{s}{c} \]

This states that the Rate of Growth of GDP is determined by the net national savings ratio \((s)\) and the national capital-output ratio \((c)\), at the same time

- Positively related to the savings ratio

- Negatively related to the economy’s capital-output ratio

Harrod-Domar: Growth Rate of Output

\[ \dfrac{\Delta Y}{Y} = \dfrac{s}{c} \]

Let’s break it down a bit

\(\dfrac{1}{c}\) measures the efficiency of capital use

- The lower the value of \(c\) (the more efficient) that an economy runs at, the greater the output that can be gained from additional investment

- A higher \(c\) means less output of \(Y\)

- If \(c\) increases, then the growth rate decreases

Harrod-Domar: Growth Rate of Output

\[ \dfrac{\Delta Y}{Y} = \dfrac{s}{c} \]

\(s\) is the economy’s saving rate, which influences the level of investment

- A higher \(s\) implies a higher investment level

- If \(s\) increases, then the growth rate increases

Harrod-Domar Lessons

In other words, the Rate of Growth depends as much on the efficiency of capital investments as the amount of capital invested

In its simplest form, a country that wants to speed up development:

1. Save more

2. Build more efficient capital

Harrod-Domar Lessons

In other words, the Rate of Growth depends as much on the efficiency of capital investments as the amount of capital invested

In its simplest form, a country that wants to speed up development:

1. Save more

Difficult for individuals in developing countries Why?

Can be helped by Foreign Aid/Investment

2. Build more efficient capital

Harrod-Domar Lessons

In other words, the Rate of Growth depends as much on the efficiency of capital investments as the amount of capital invested

In its simplest form, a country that wants to speed up development:

1. Save more

2. Build more efficient capital

- Technology helps with making capital more efficient

Harrod-Domar Simple Example

- In 2011, Indonesia had a capital-output ratio of 4

\[ \dfrac{K}{Y} = c = 4 \]

If we want a growth rate of 6%, Harrod-Domar tells us that Indonesia needs a savings rate of?

\(\dfrac{\Delta Y}{Y} = \dfrac{s}{c}\) \(\Rightarrow 6 = \dfrac{s}{4}\) \(\Rightarrow 24 = s\)

Harrod-Domar Growth Model

With theoretical models, you should always ask yourself:

What? Why? Huh?

- Why this model?

- After World War II, much of Europe was destroyed

- There was a lack of capital \((K)\)

- The Marshall Plan was a large foreign aid package from the US to Western Europe

- The aid package greatly sped up recovery of Europe and boosted economic growth

- What does it do?

- Explains how savings, capital, and output are potentially linked together

- Huh? That’s not realistic

Criticisms of Harrod-Domar

No model is perfect

But good models help explain a small part of life

But these are not without proper criticism:

- Overly simplified

- No population growth

- No technology change

- The \(K = cY\) assumption is concerning

- Assumes that turning capital into output is easy

- Assumes constant returns to capital

- Policy enacted based on the model did not increase economic growth significantly

Solow Growth Model

Model 02 - Solow Growth Model

Now we can add some important features

- Population growth

- Technological change

- Emphasizes looking at outcomes in per worker terms

Solow Growth Model Assumptions

1. Output per worker \(y\) depends only on the amount of capital per worker \(k\)

2. Every worker saves a proportion \(s\) of their income

3. Population grows at rate \(n\)

4. Capital depreciates at rate \(\delta\)

5. Capital stock depends on new investment

Solow Growth Model Assumptions

1. Output per worker \(y\) depends only on the amount of capital per worker \(k\)

\[ y = f(k)\]

- \(f()\) is increasing (more capital leads to more output)

- \(f()\) is concave (decreasing returns to capital)

2. Every worker saves a proportion \(s\) of their income

3. Population grows at rate \(n\)

4. Capital depreciates at rate \(\delta\)

5. Capital stock depends on new investment

Solow Growth Model Assumptions

1. Output per worker \(y\) depends only on the amount of capital per worker \(k\)

2. Every worker saves a proportion \(s\) of their income

\[0 \leq s \leq 1\]

3. Population grows at rate \(n\)

4. Capital depreciates at rate \(\delta\)

5. Capital stock depends on new investment

Solow Growth Model Assumptions

1. Output per worker \(y\) depends only on the amount of capital per worker \(k\)

2. Every worker saves a proportion \(s\) of their income

3. Population grows at rate \(n\)

4. Capital depreciates at rate \(\delta\)

5. Capital stock depends on new investment

Solow Growth Model Assumptions

1. Output per worker \(y\) depends only on the amount of capital per worker \(k\)

2. Every worker saves a proportion \(s\) of their income

3. Population grows at rate \(n\)

4. Capital depreciates at rate \(\delta\)

5. Capital stock depends on new investment

- Every time period workers save some of their income \(sf(k)\)

- However, capital depreciates so we lose \(\delta k\)

- The populations grows at rate \(n\) so the capital per worker gets smaller by \(nk\)

Solow - Change in Capital per Worker

\(\Delta k\) \(=\) \(sf(k)\) \(-\) \(nk\) \(-\) \(\delta k\)

\(\Delta k\): Growth of capital per worker

\(sf(k)\): Savings

\(nk\): Net new workers

\(\delta k\): Capital depreciation

Solow - Change in Capital per Worker

\(\Delta k\) \(=\) \(sf(k)\) \(-\) \(nk\) \(-\) \(\delta k\)

\(\Delta k\): Growth of capital per worker

The more capital a worker has to work with, the more output that they can produce

The change in capital per worker depends on the other components

\(sf(k)\): Savings

\(nk\): Net new workers

\(\delta k\): Capital depreciation

Solow - Change in Capital per Worker

\(\Delta k\) \(=\) \(sf(k)\) \(-\) \(nk\) \(-\) \(\delta k\)

- \(\Delta k\): Growth of capital per worker

\(sf(k)\): Savings (Positive)

- Each worker saves a proportion of their income and is reinvested into “capital in the future”

\(nk\): Net new workers

\(\delta k\): Capital depreciation

Solow - Change in Capital per Worker

\(\Delta k\) \(=\) \(sf(k)\) \(-\) \(nk\) \(-\) \(\delta k\)

\(\Delta k\): Growth of capital per worker

\(sf(k)\): Savings

\(nk\): Net new workers (Negative)

Population (workers) grow at a rate \(n \geq 0\) (usually very small)

As there are more people, there is less capital per worker determined by \(nk\)

- \(\delta k\): Capital depreciation

Solow - Change in Capital per Worker

\(\Delta k\) \(=\) \(sf(k)\) \(-\) \(nk\) \(-\) \(\delta k\)

\(\Delta k\): Growth of capital per worker

\(sf(k)\): Savings

\(nk\): Net new workers

\(\delta k\): Capital depreciation (Negative)

- Capital requires service (repairs) We lose \(\delta k\) every period

- \(0 < \delta < 1\)

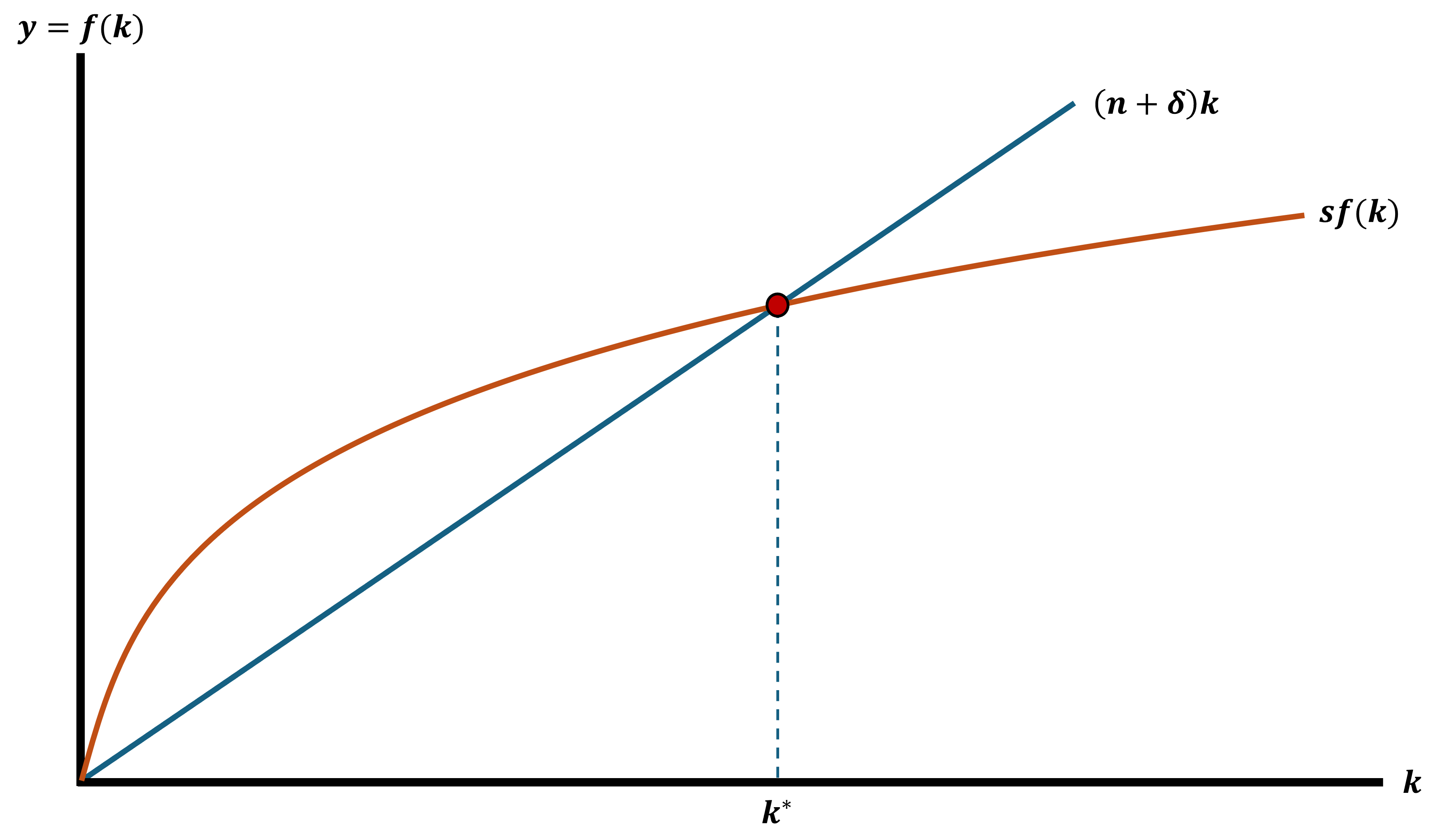

Solow Growth Model - Steady State

The Solow Model allows us to consider a steady state level of capital

- Steady State: When the economy has fully adjusted and there is no change in some variable

- The economy is in an equilibrium that is stable

- Output and capital per worker are no longer changing

We want \(k\) to be in steady state

This means that \(\Delta k = 0\) Because \(k\) is no longer changing

We call this level of capital \(k^{*}\)

Solow Growth Model - Steady State

When the economy is in steady state \(k^{*}\) we have:

\[ \Delta k = 0 = sf(k^{*}) - (n + \delta)k^{*} \\ sf(k^{*}) = (n + \delta)k^{*} \]

More than the math, I want you to understand this intuitively

- Graphs are great to be able to talk about this

Steady State

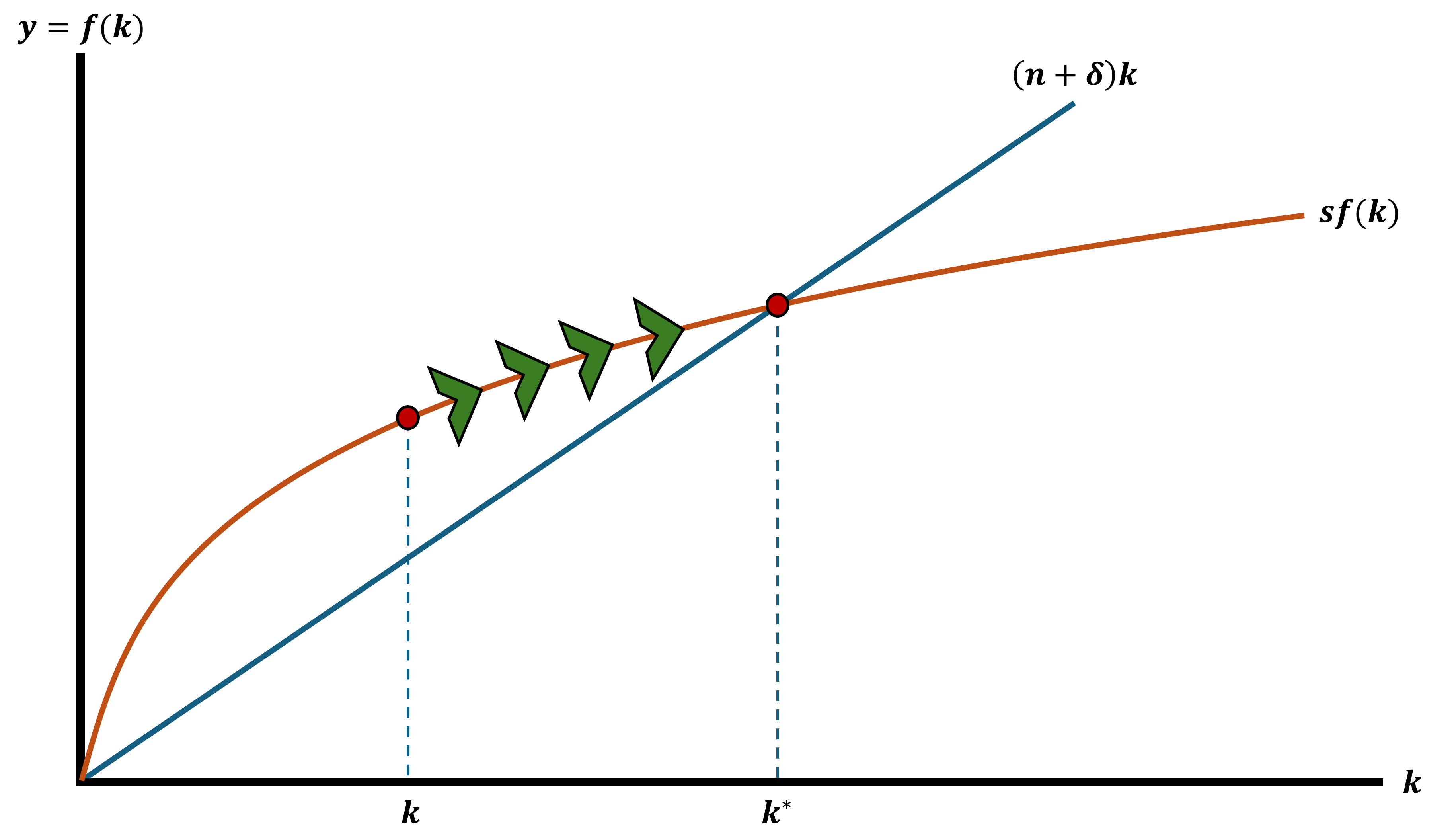

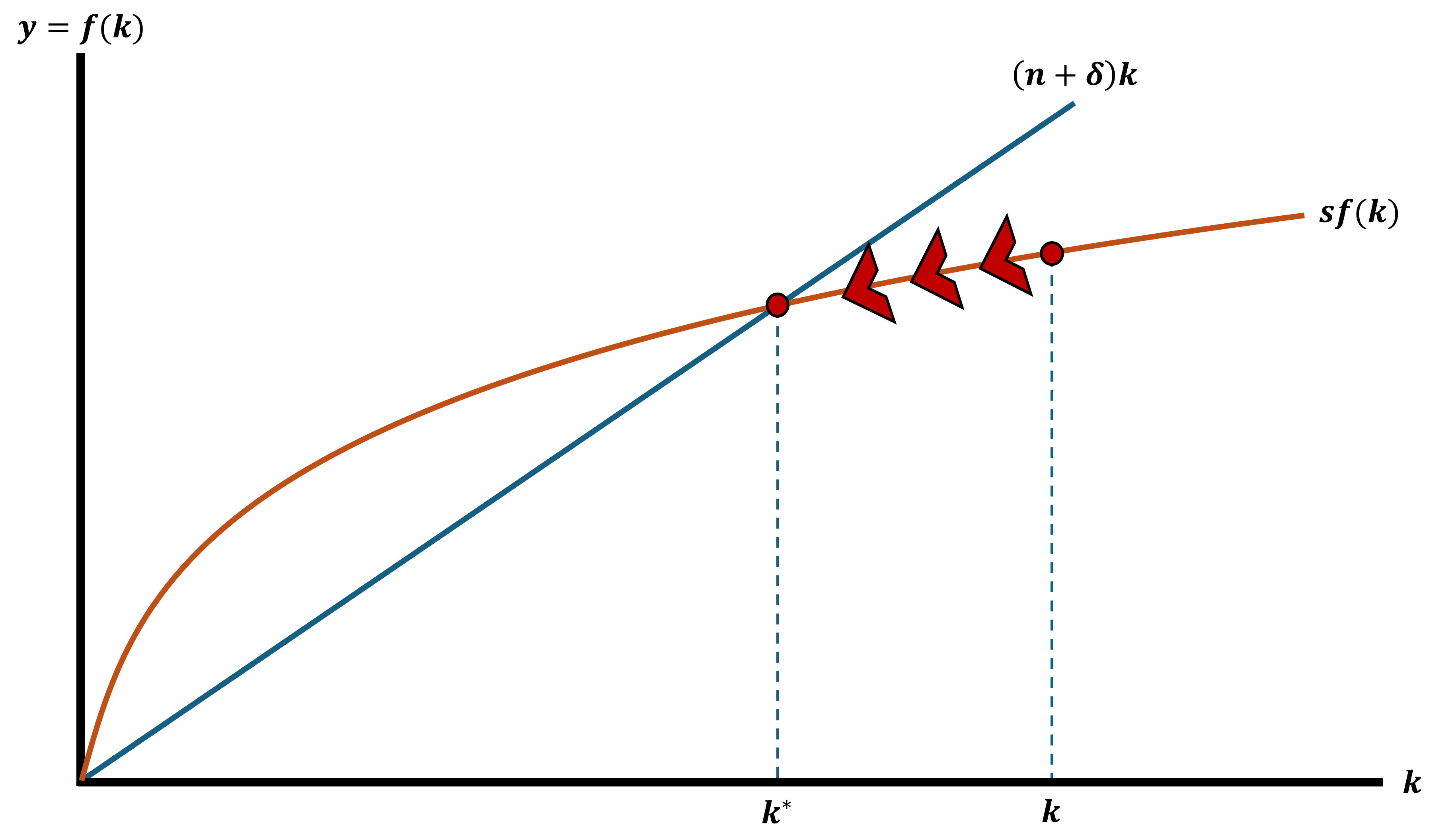

Out of Steady State

Out of Steady State

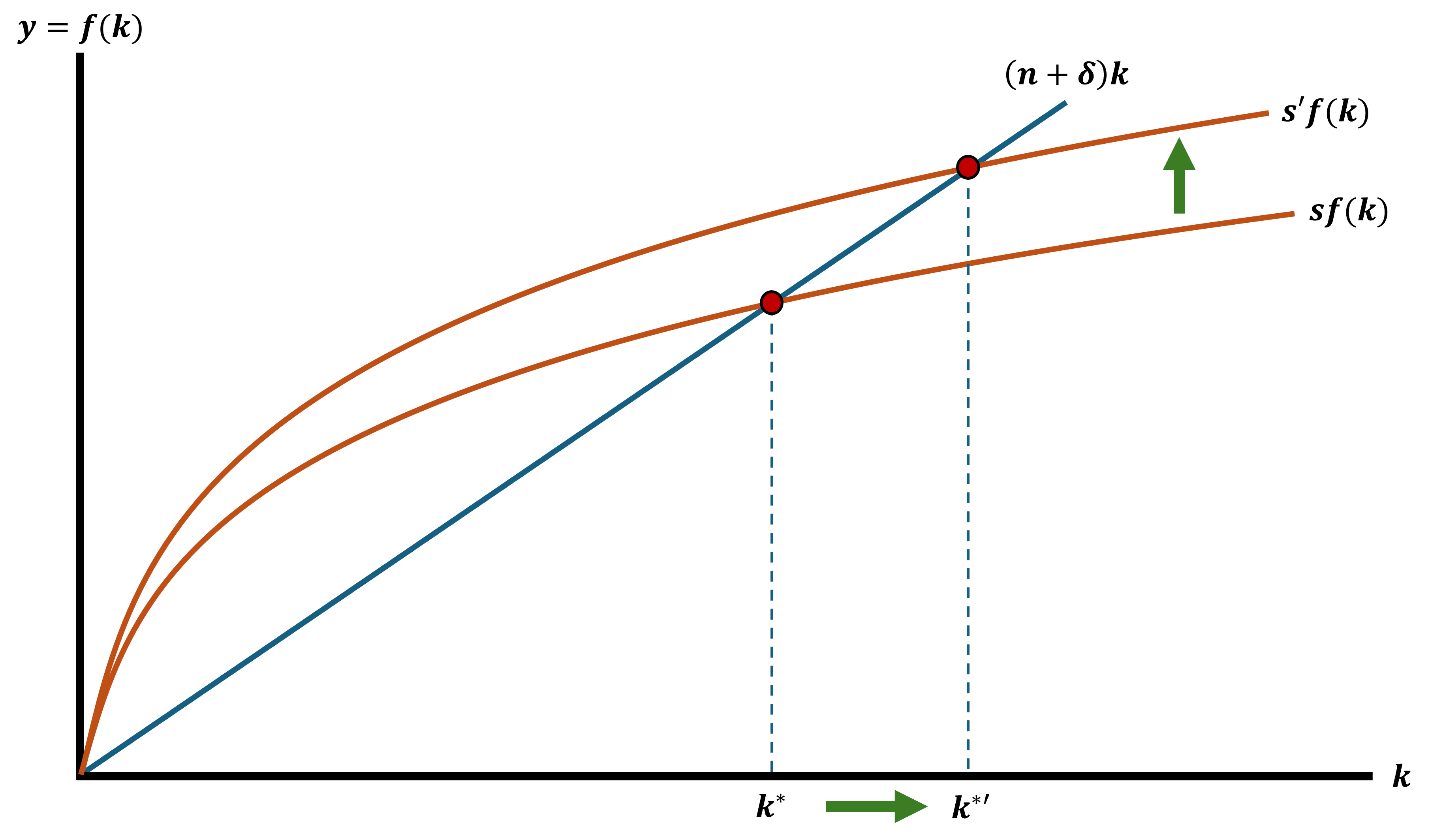

Increase in Savings Rate

Solow Growth Model Dynamics

Be aware of all the possible moving pieces in this model

It allows us to explore the effects of changes in:

- \(s\): Savings Rates

- \(\delta\): Depreciation Rate

- \(n\): Population Growth Rate

Solow Growth Model

What? Why? Huh?

Why this model?

- It is a simple and intuitive way of understanding how savings, population growth, and technology change impacts long-run economic growth

- What does it do? Decomposes growth into two key forces

1. Capital accumulation through savings and investment

2. Population growth as the labor force expands

- Huh? Again with this fantasy stuff?

Criticisms of Solow

There is a constant savings rate that is exogenously given

Ignores human capital

Predicts too much convergence

- Economies with the same rates \((s,n,\delta)\) should reach the same output per person

No role for institutions or policy

Treats labor as homogeneous where all workers are the same

Structural Change Models

Lewis Two-Sector Model

Was the general theory of the development process in surplus-labor developing nations in the 60s and 70s

Focuses on structural transformation of a primarily subsistence economy

- Definition: A major alteration in the industrial composition of any economy

- Usually we talk about moving from subsistence agricultural sector to manufacturing sector

Model Set Up

There is an underdeveloped economy with:

Two Sectors

1. A traditional, overpopulated, rural subsistence sector

2. A high-productivity, modern, urban industrial sector

- Primary Focus

- Process of labor transfer/movement between sectors

- Growth of output and employment in the industrial sector

The transfer of labor between sectors and employment growth in the industrial sector is due to expansion in the industrial sector

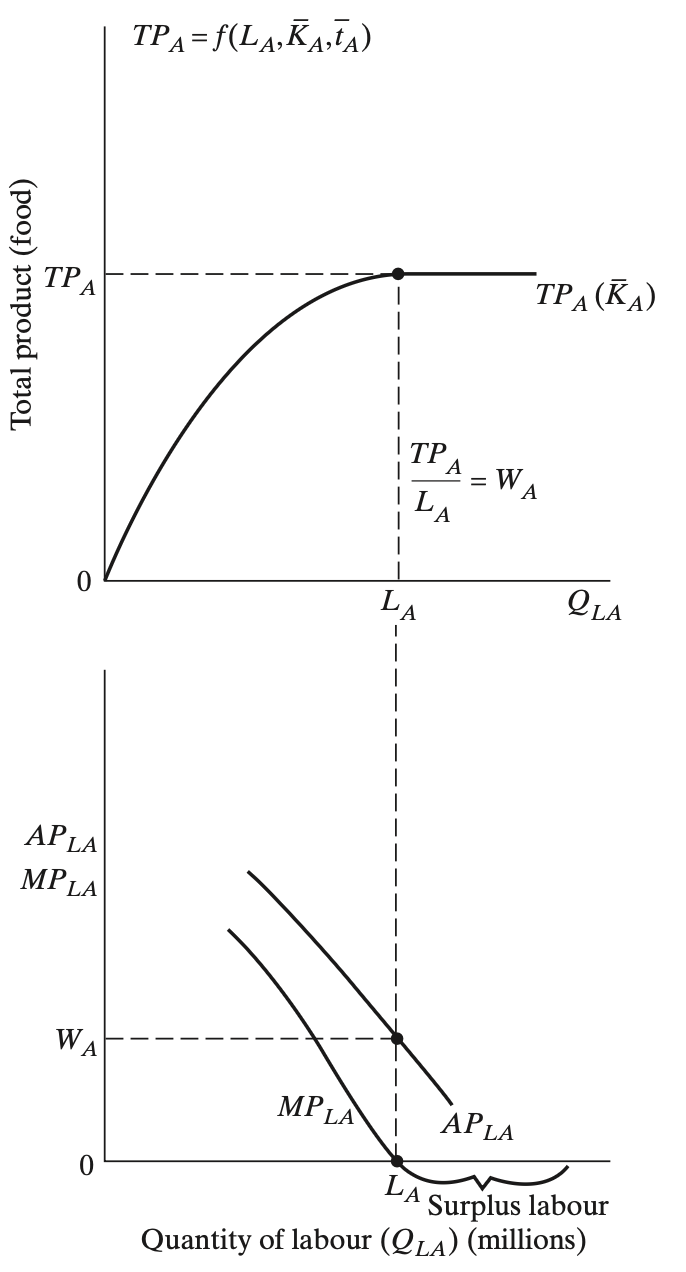

Industrial Sector Expansion

The speed at which the industrial sector grows is determiend by investment and capital accumulation in that sector

- Capitalists make profits in the industrial sector above paid wages

- Assume that they invest it all back into the sector (more capital enters)

- Capital stock increases and they hire more labor

Some questions/doubts arise

1. Where is all the labor coming from? I thought the other side was a subsistence agricultural sector?

2. I thought economists didn’t believe in positive profits

3. Capital only increases in the industrial sector?

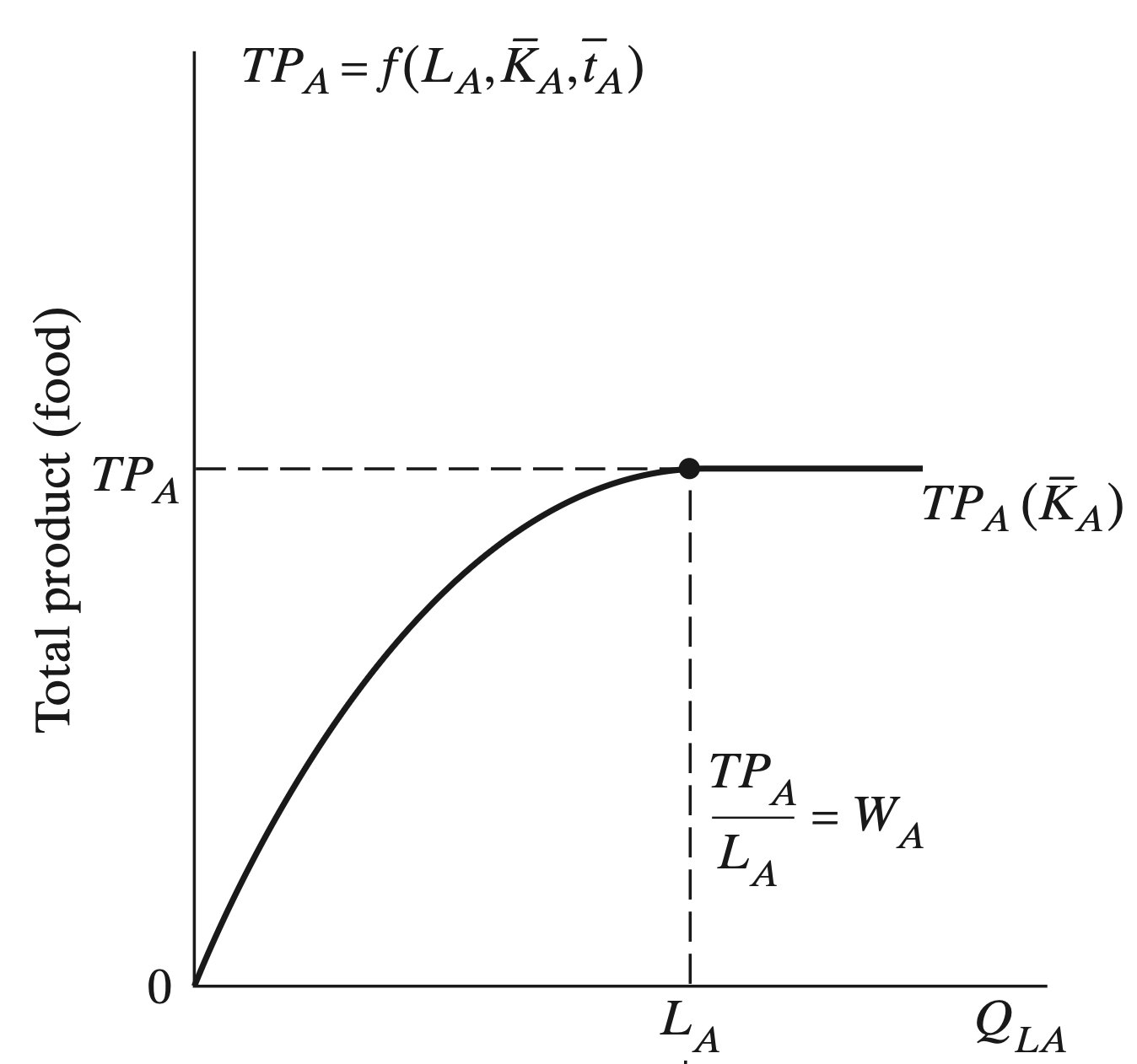

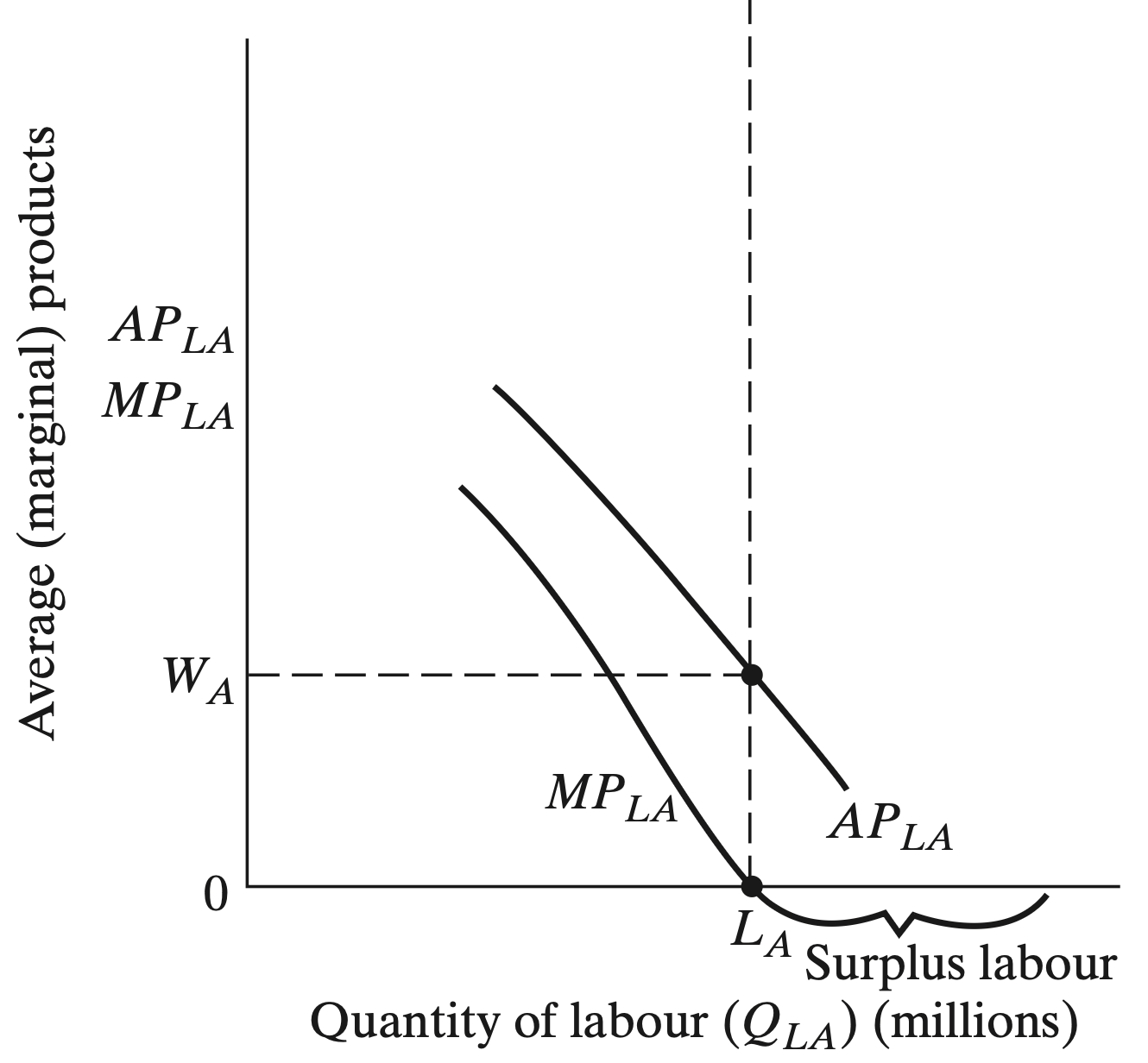

Subsistence Agricutural Sector

There are two primary assumptions to consider

1. There is a surplus of labor

- Marginal productivity of labor \((MP_{LA})\) is zero

2. All rural workers share their output equally

- Rural wages are determined by the average product of labor

- There are \(L_{A}\) agricultural workers that produce \(TP_{A}\) food

- They share food equally as \(W_{A}\) per person

Subsistence Agricultural Sector (Production)

Subsistence Agricultural Sector (Labor Demand)

Subsistence Agricultural Sector (Both)

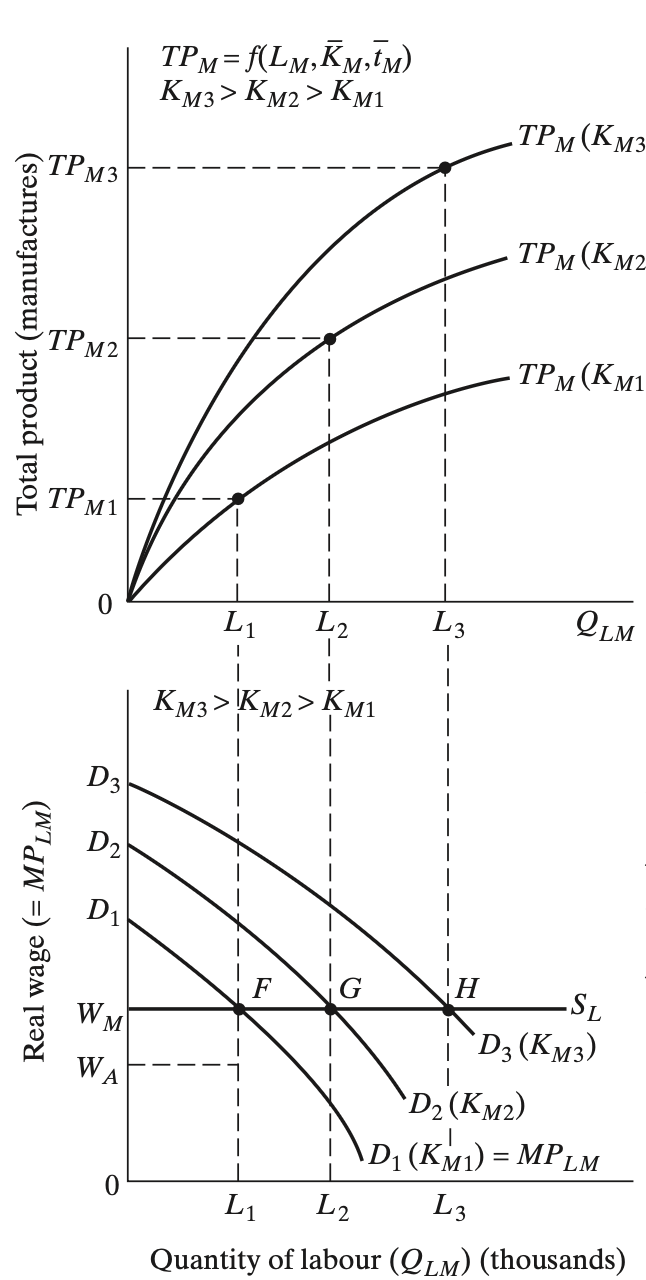

Industrial Sector (Production)

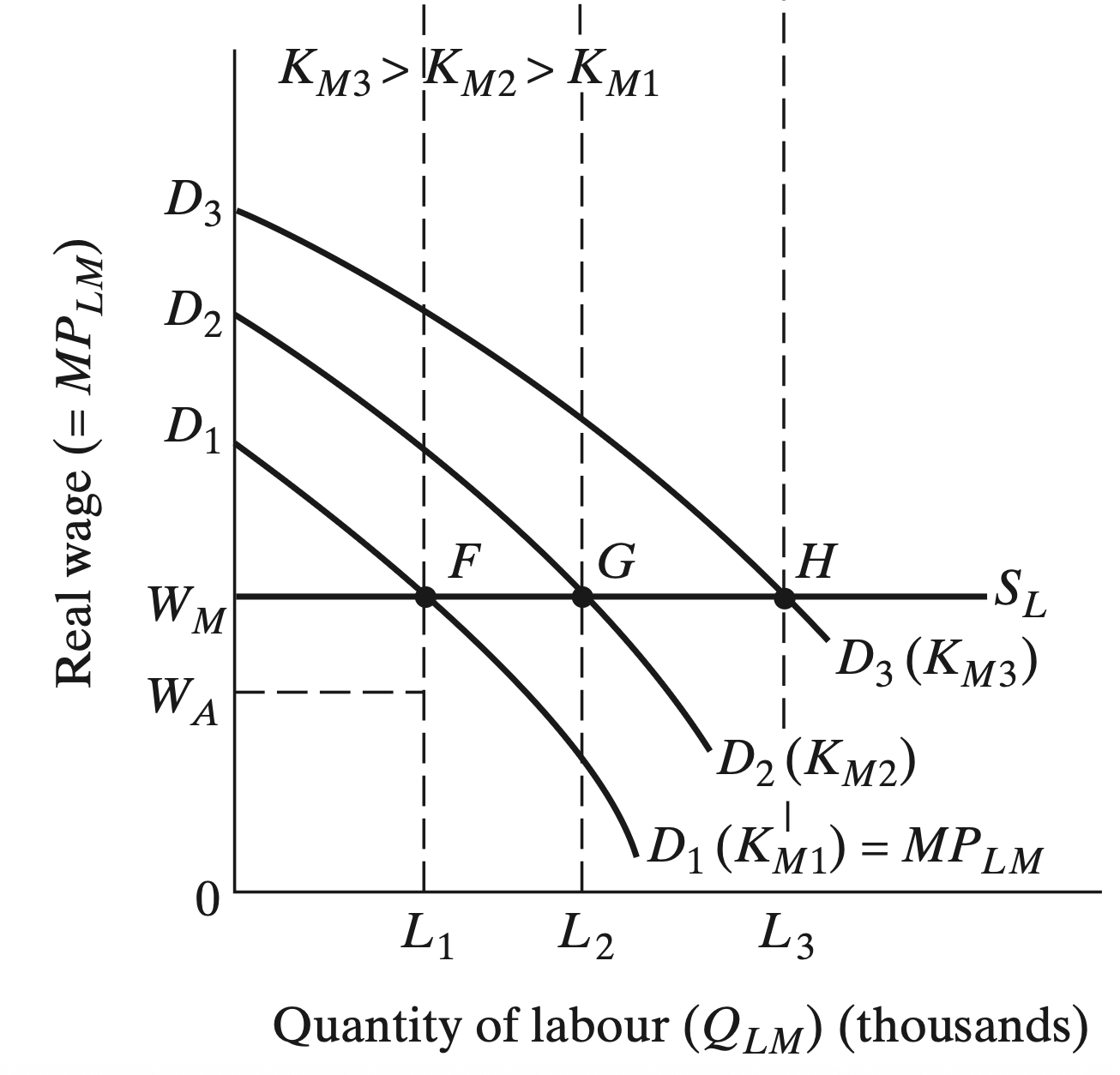

Industrial Sector (Labor Demand)

Industrial Sector (Both)

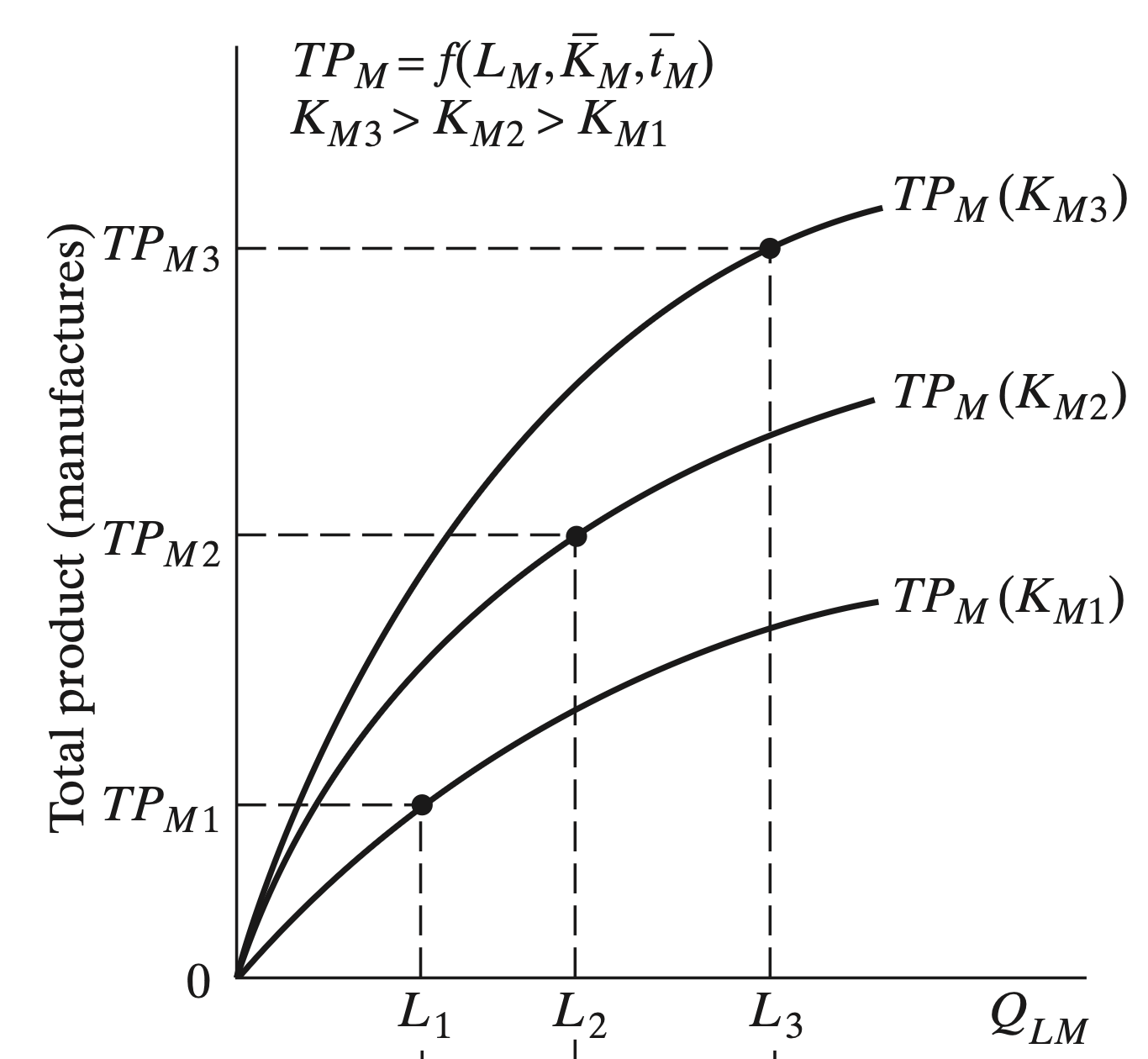

Wage Differences

Agricultural wages are lower than wages in the industrial sector

- Supply of agricultural labor is assumed to be perfectly elastic/unlimited

- This means that at industrial wages \((W_{M})\) above agricultural wages \((W_{A})\), the industrial sector can hire as many surplus workers as they want without fear of raising wages

- We assume labor to have diminishing returns (1 more labor \(\neq\) 1 more output)

- The profit-maximizing industrial sector hires labor until their marginal product is equal to the real wage

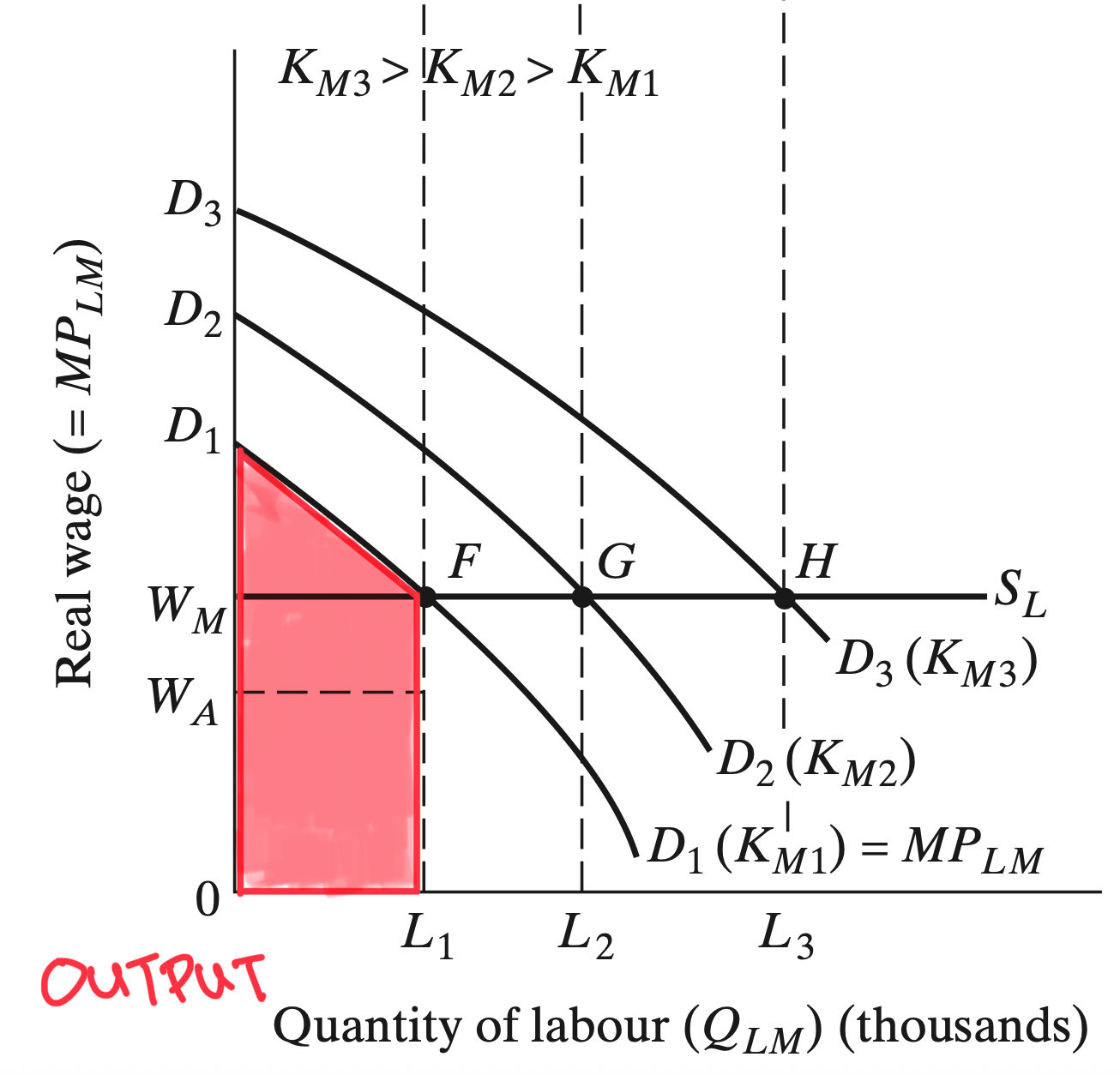

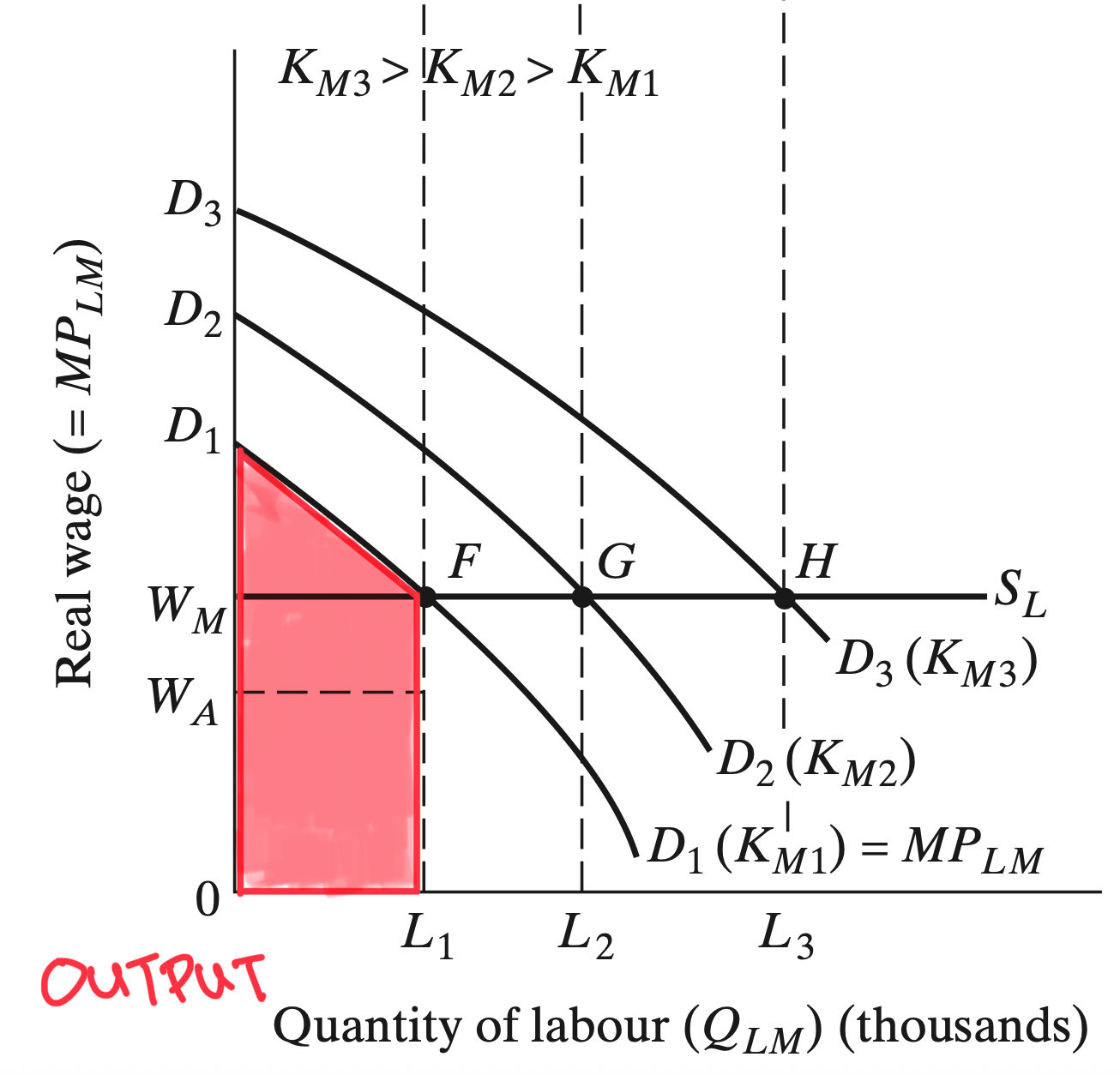

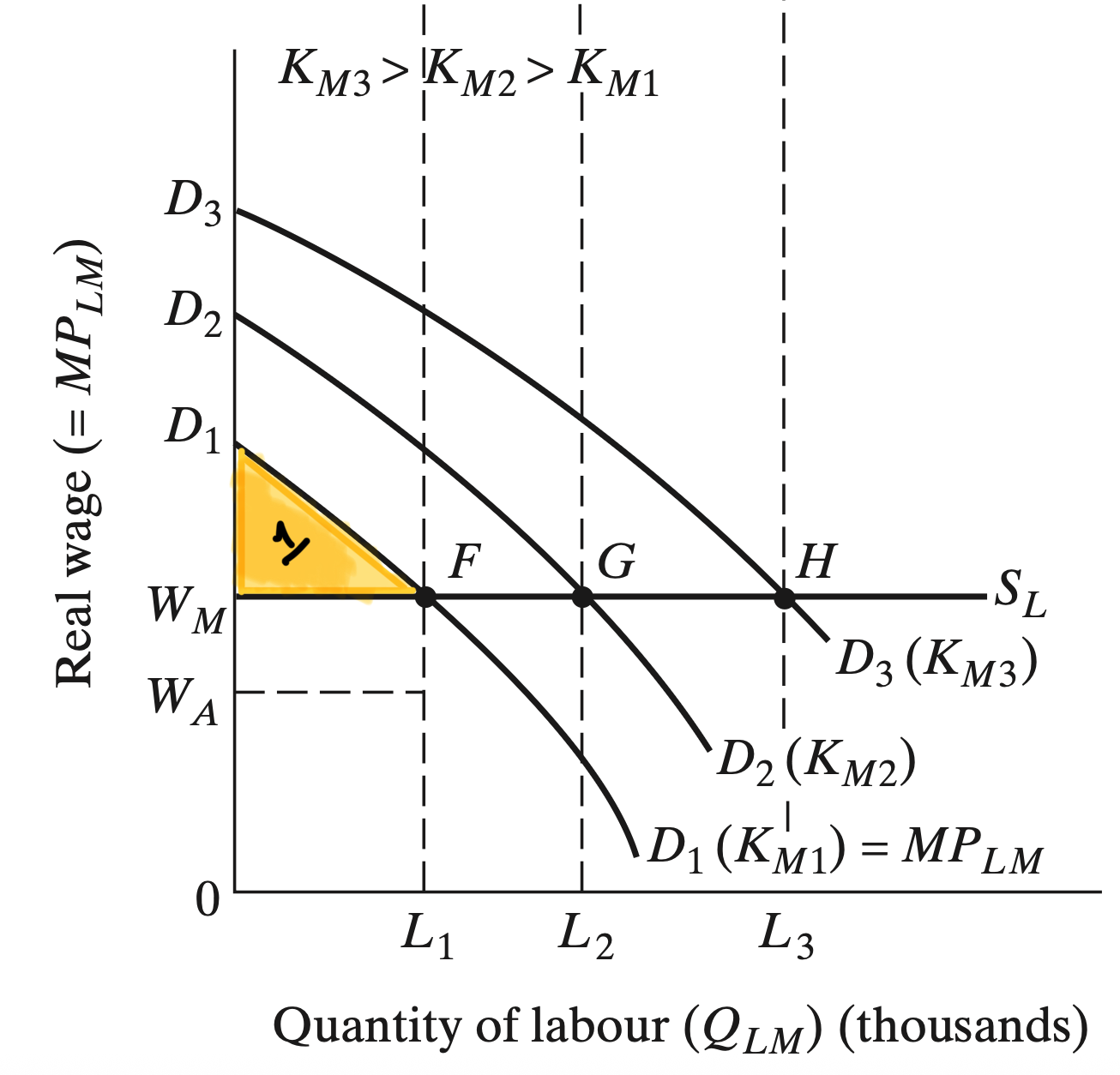

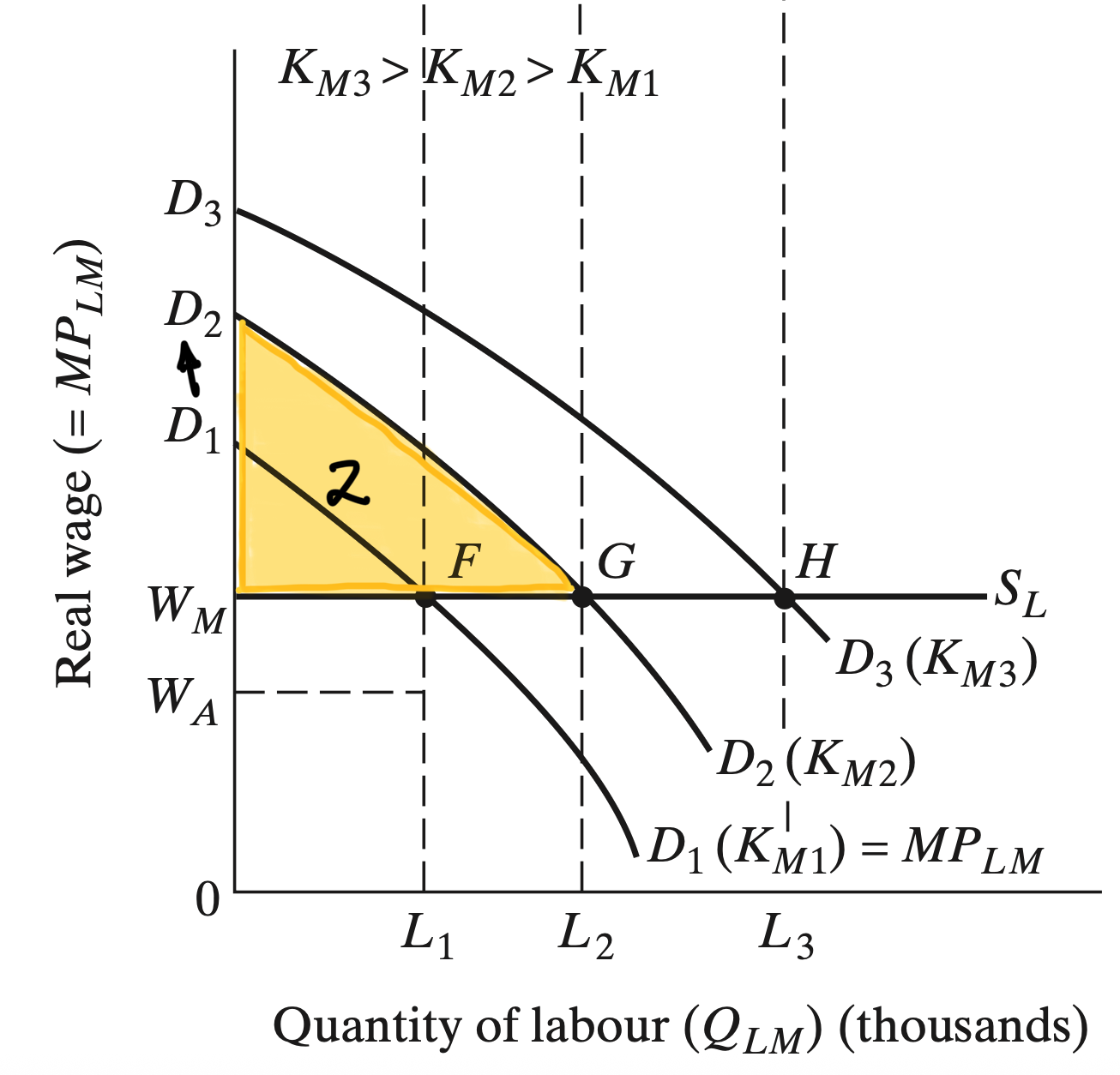

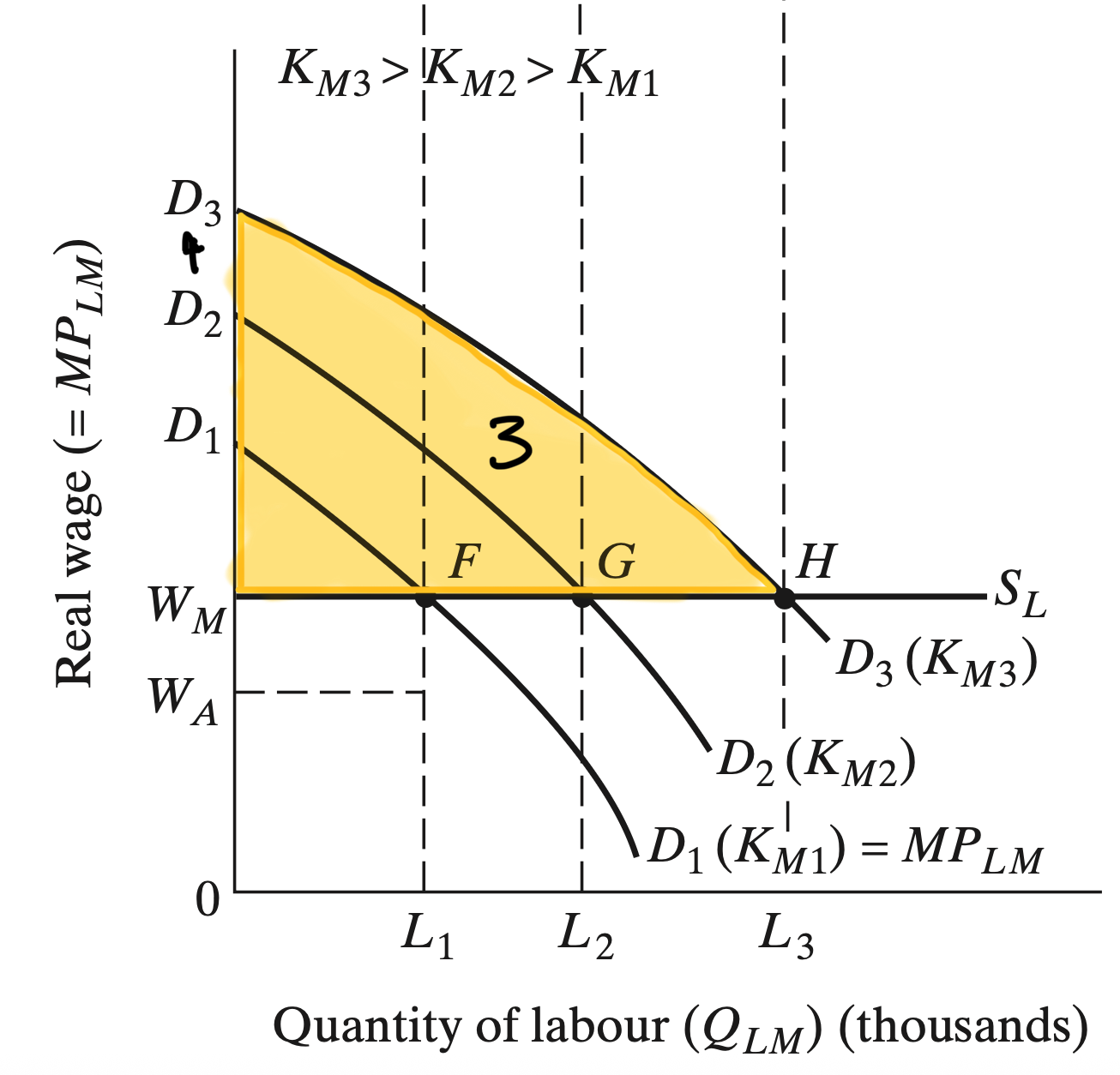

Industrial Sector Output

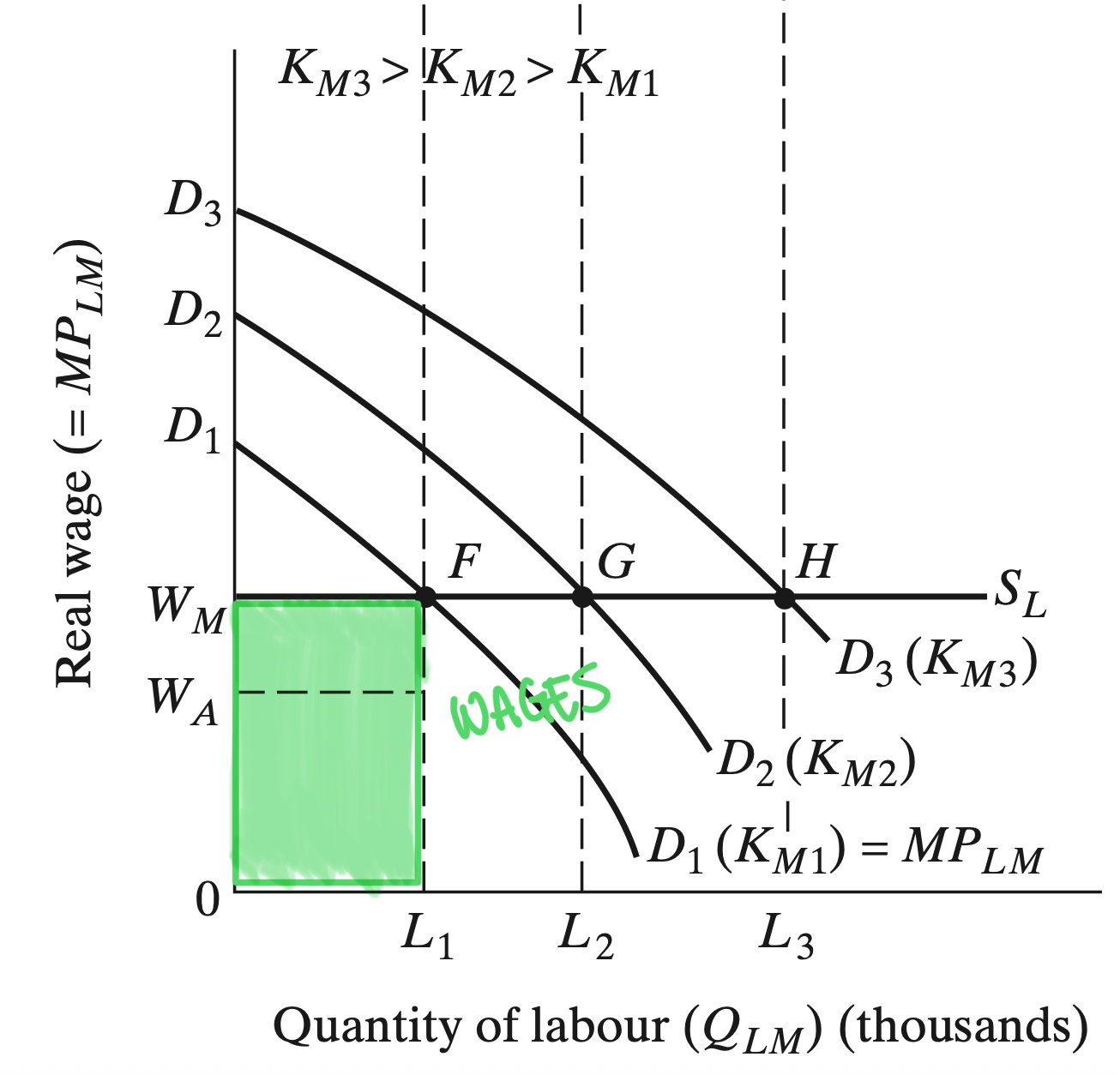

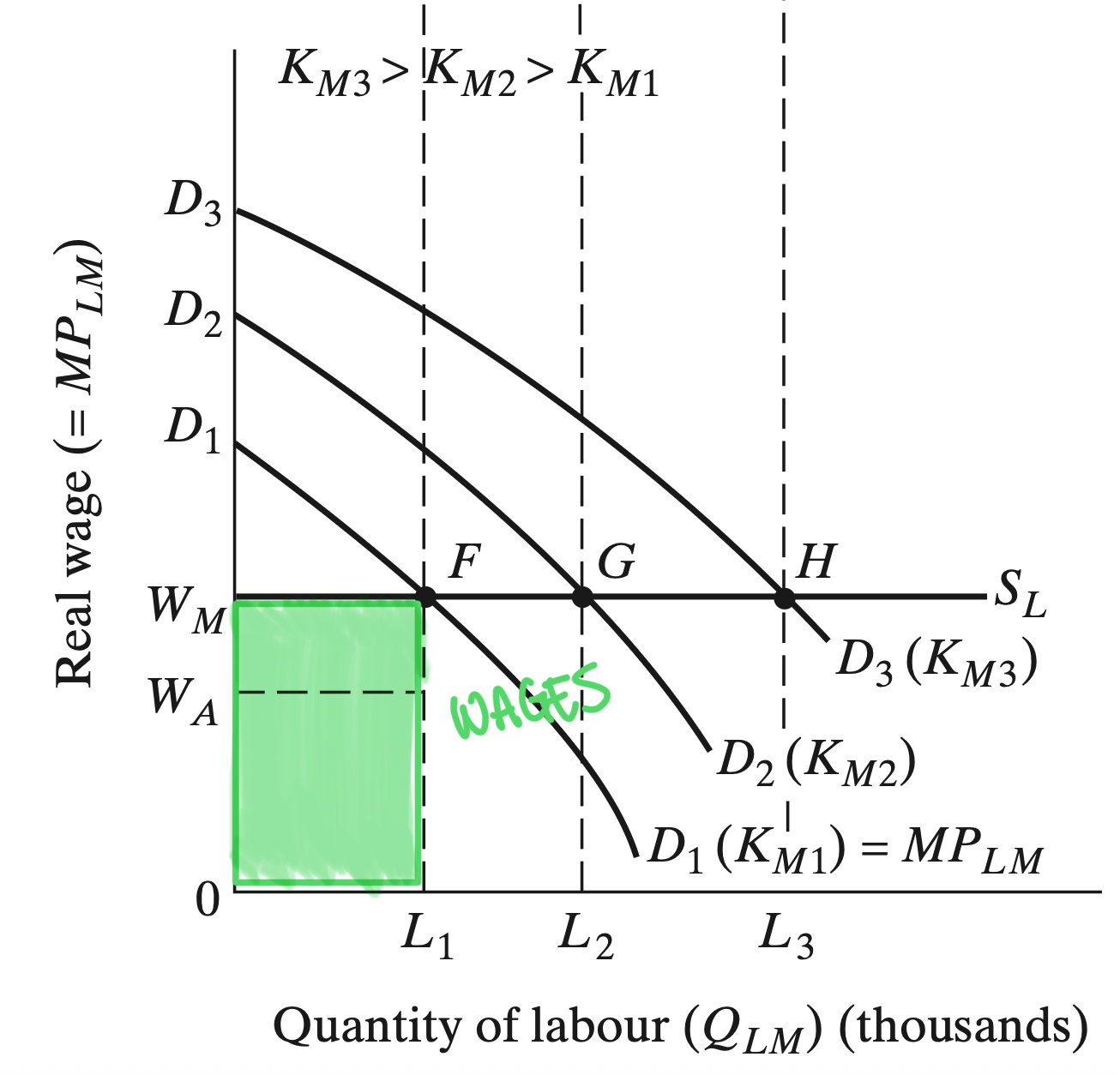

Industrial Sector Wages

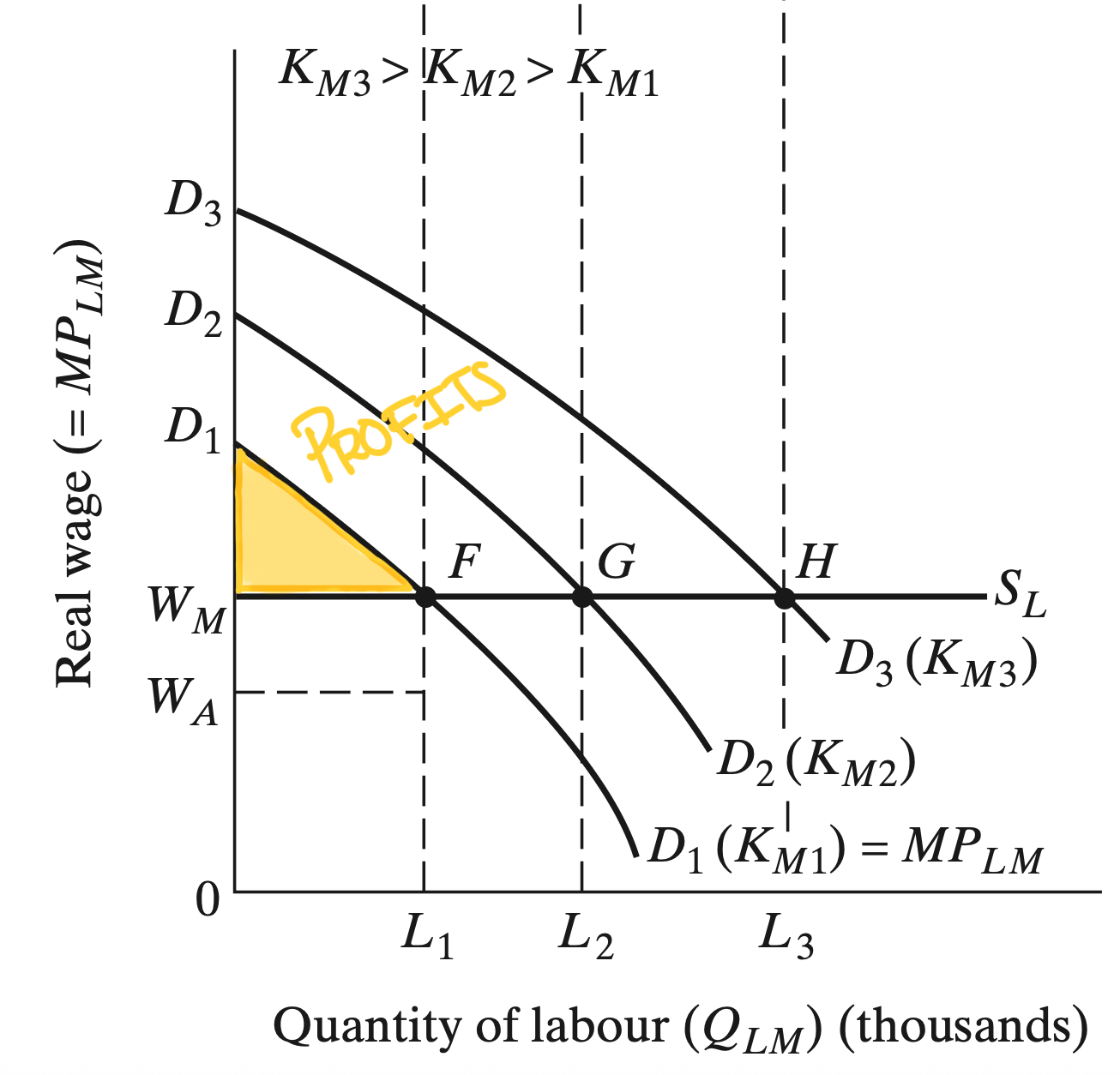

Industrial Sector Profits

All Together

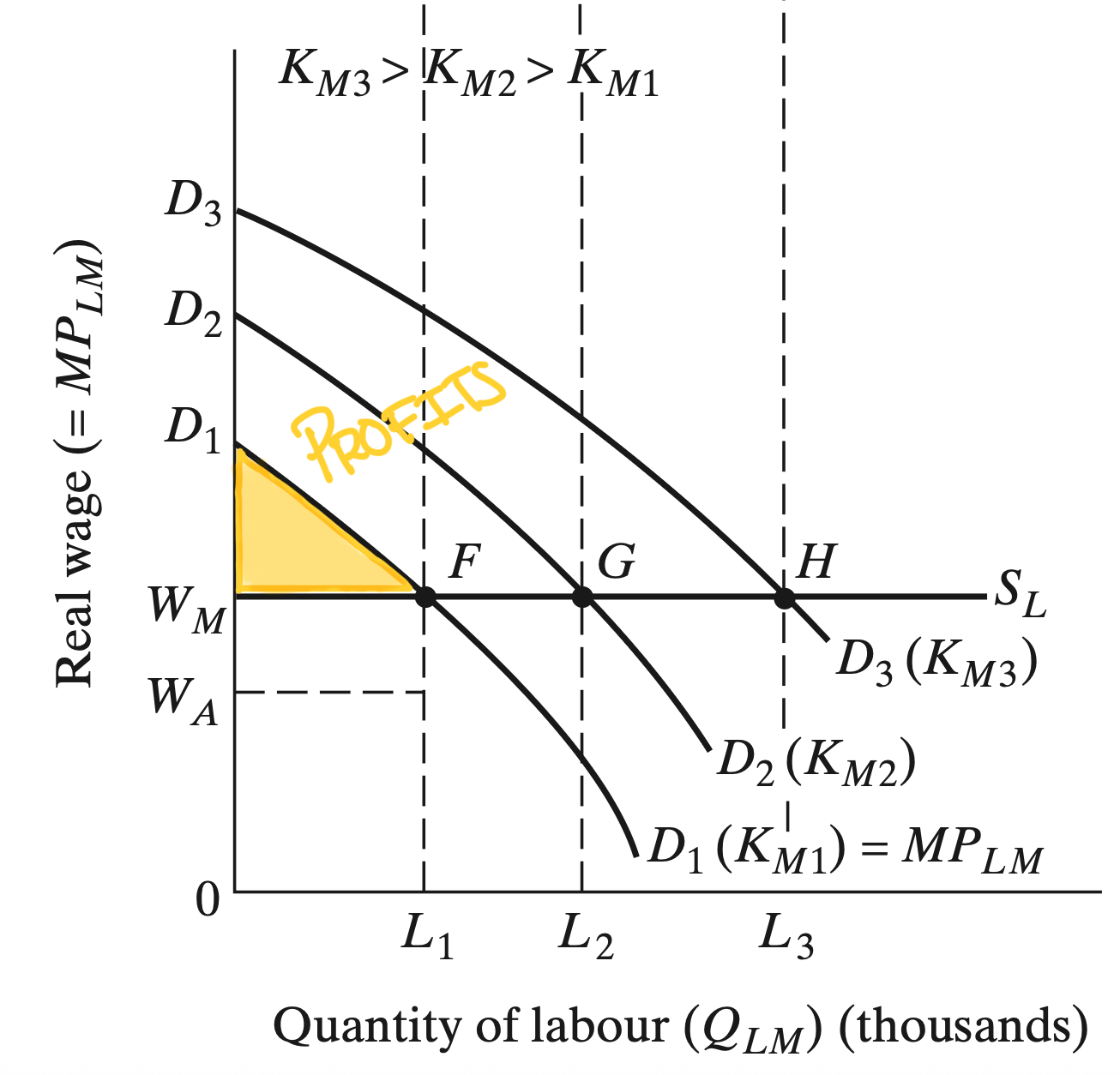

Investments

Investments

Because the industrial sector owners make a positive profit and they fully reinvest those back into capital

We get self-sustaining growth

This will happen until all surplus rural labor is absorbed into the industrial sector

The industrial sector can extract additional workers at a higher cost since it would now imply a loss of food production

This is the Lewis Turning Point

- The labor supply curve becomes positively sloped in the industrial sector and wages increase in the economy

- Eventually the market goes through a structural transformation where it shifted from a traditional rural agricultural to a modern urban industrial setting

EC390, Lecture 02 | Theories